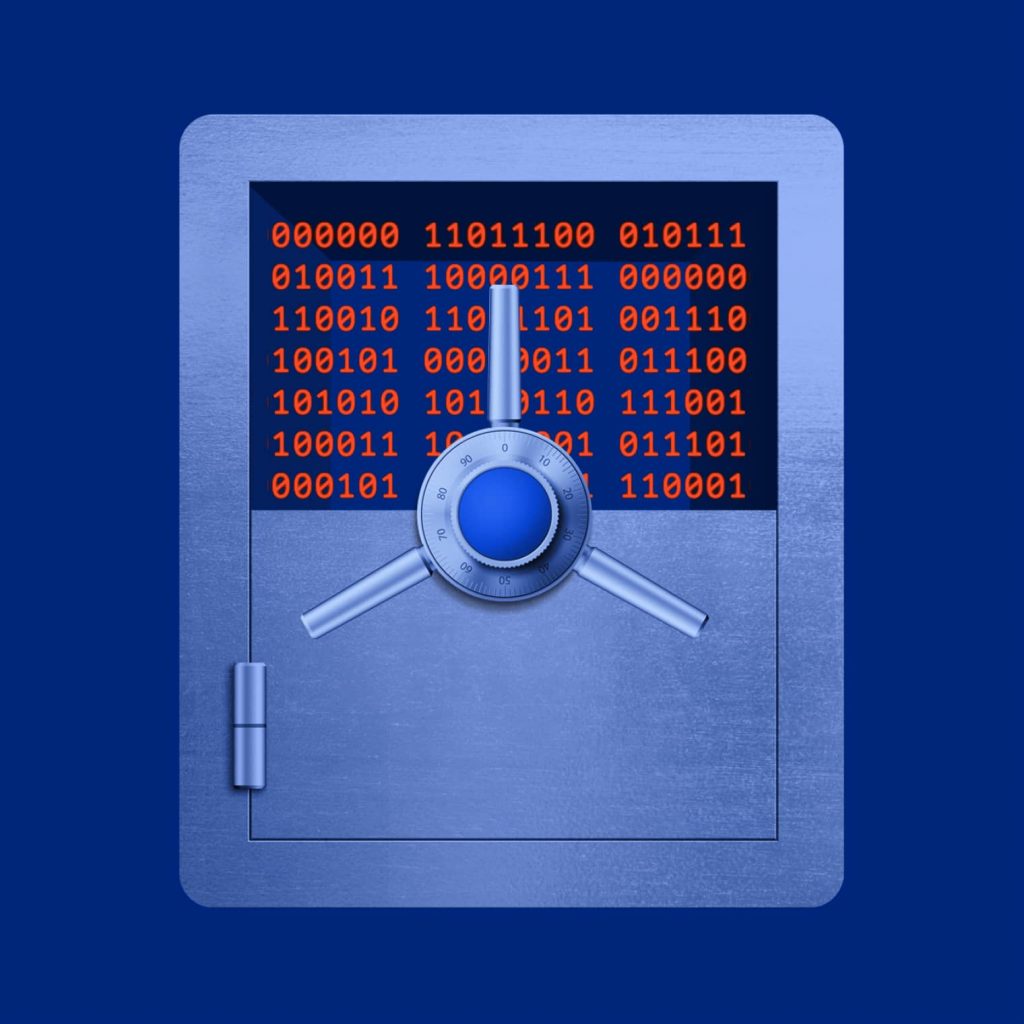

A blockchain is a digital ledger of an activity that is duplicated and distributed across the entire network of computer systems on the blockchain. Sounds tricky, right? In fact, blockchain is easier to understand than that definition sounds. People join a completely open network and use their personal computers to hold records submitted by others. They receive a full copy of the blockchain. At its most basic level, it is just a chain of blocks, in chronological order, that contain information.

- Each block consists of specific data including the hash of the block and the hash of the previous block.

- The data stored inside the block depends on the type of blockchain. For example, the block may store information about transactions. Thus, it will contain the date, time, and amount of the transaction. It also stores information about the participants in the transaction. However, instead of using the participants’ actual names, it uses a unique digital signature.

- Hash is a cryptographic code created by special algorithms. The hash of the block is as unique as a fingerprint and calculated once the block is created. Hash allows us to tell what information the block stores and distinguish it from other blocks. Changing something inside the block changes the hash.

- Since the third element inside each block is the hash of the previous block, it effectively creates a chain of blocks. If someone tampers with a block, it will cause the hash of the block to change. Thus, it will make all following blocks invalid, because they no longer store a valid hash of the previous block.

It is possible to look back at the history of a blockchain and divide it into nominal stages, which are marked off by important developments and inventions.

Stage 1: Blockchain background

The history of blockchain technology can be traced through a number of innovations that can now be considered predecessors to the emergence of blockchain.

Peer-to-peer network formation

Peer-to-peer (P2P) is a decentralized infrastructure in which two or more computers or devices connect to share and exchange resources. The history of the P2P network is permeated with numerous initiatives, such as the ARPANET (1969) client-server network that initially connected the UCLA, Stanford Research Institute, UC Santa Barbara and the University of Utah, while treating them as equal computing peers, and the USENET (1979) distributed messaging system. However, while P2P systems had previously been used in several application domains, the concept was popularized with the introduction of the Napster music-sharing application, developed by Shawn Fanning in 1999.

PKI and PGP encryptions introduction

Public Key Infrastructure (PKI) and Pretty Good Privacy (PGP) are cryptographic protocols used for the encryption of information for safe exchange over the Internet. The exchange happens with the help of the public and private keys of each user. To deliver the information to a certain recipient, a sender obtains the recipient’s public key and uses it to encrypt the information. The information can then only be decrypted using the recipient's private key.

The difference between those two encryptions lies in how the two parties learn to trust each other in order to exchange messages securely. PKI has a hierarchical arrangement established through a process of registration and issuance of certificates at and by certificate authorities (CAs). Thus, a user trusts the identity of the key and its owner, relying on the certificate authority responsible for accepting requests for digital certificates and authenticating the party making the request. PGP encryption, formalized in 1991 by Phil Zimmerman, is a little different.

PGP adopts a distributed trust network for certificate identity confirmation, known as the "Web of Trust." There is no central authority that everybody trusts; instead, participants sign each other's keys and progressively build a web of individual public keys interconnected by links formed by these signatures.

Proof-of-work approach

Proof of work (PoW) is a protocol with the primary goal of deterring cyber-attacks. The protocol exhausts the resources of a computer system by sending multiple fake requests. PoW idea was originally published by Cynthia Dwork and Moni Naor back in 1993. However, the term "proof-of-work" was coined by Markus Jakobsson and Ari Juels in a document published in 1999, a decade before the invention of Bitcoin.

Blockchain outline

The blockchain technique was described in 1991 by Stuart Haber and Scott Stornetta. It was originally intended to timestamp digital documents so that it was not possible to backdate them or to tamper with them.

In 1992, Merkle trees were incorporated into the design and became the first instance of any blockchain implementation. Merkle trees created a series of data records, each connected to the one before it. The newest record in the chain would contain the history of the entire chain, making it more efficient by allowing several documents to be collected into one block. However, it went largely unused until the creation of digital cryptocurrency.

Stage 2: Blockchain establishment

In 2008, Satoshi Nakamoto (a pseudonym used by an individual or a group of individuals) published online a document called "Bitcoin: a peer-to-peer electronic cash system." In short, Satoshi's creation enabled a participant to digitally transact directly with another participant without relying on an intermediary, such as a bank, to process the payments.

In 2009, Nakamoto implemented the first blockchain as an alternative to the current financial system. It was the public ledger for transactions made using bitcoin.

Hal Finney became the first recipient of bitcoin when he received ten bitcoins from Satoshi Nakamoto. In some sense blockchain was designed specifically for Bitcoin; however, since then, it has taken on new roles in a variety of other areas.

Stage 3: Drifting away from digital currency

In late 2013, with the surge of attention to the bitcoin codebase, Vitalik Buterin, programmer and co-founder of Bitcoin Magazine, started the development of a new blockchain-based computing platform called Ethereum. The major innovation brought by Ethereum was the advent of smart contracts. Smart contracts, or programmable instructions, are deployed and executed on the Ethereum blockchain and can be used to make a transaction without involving third parties if certain conditions are met.

In 2016, IBM donated what was to become known as the Hyperledger Fabric, one of the biggest distributed ledger projects under the Hyperledger umbrella. In 2017, Vitalik Buterin announced his plans to switch the Ethereum network's mining technique from proof of work to proof of stake.

According to the proof-of-work algorithm, a higher hash rate means a higher chance to create the next block and receive the mining reward. Thus, proof of work provokes people to team up into mining pools to increase their chances of mining a new block. If those mining pools were to have a majority stake in the network, they could start approving fraudulent transactions in what is known as a 51% attack. It refers to an attack on a blockchain by a group of miners who together control more than 50% of the network's mining hash rate or computing power. Such a group would be able to prevent new transactions from gaining confirmations, allowing them to halt payments between some or all users. The group would also be able to reverse transactions that were completed while they were in control of the network, meaning they could double-spend coins.

Proof of stake, on the other hand, uses an election process which chooses one validator to create the next block. To become a validator, a person must deposit a stake, a certain amount of coins, into the network. Thus, the proof-of-stake algorithm does not require expensive mining equipment and encourages more people to become validators, using less energy and making the network more decentralized.

In 2018, the U.S. state of Arizona passed a bill to allow residents to pay their taxes with bitcoin. The Spanish banking group BBVA, the Swiss multinational investment bank UBS, and Microsoft have expressed interest in blockchain-based smart contracts.

Stage 4: Blockchain today

At the moment, blockchain technology is gaining a lot of mainstream attention and is already used in a variety of ways, not limited to cryptocurrencies. Forbes Blockchain 50 is a list of the top 50 companies and organisations that are adopting decentralised ledgers to their operational needs.

The second annual Blockchain 50 List, released at the beginning of 2020, proves that global entities continue to embrace blockchain technology. As more businesses now are considering an opportunity to partner with a trusted blockchain development company, many blockchain projects have moved beyond theoretical or testing phases to producing real transactions, cost savings, and other benefits.

Blockchain and the finance industry

The financial services industry has embraced blockchain to improve many outdated systems and save money. Blockchain offers a lot of benefits for financial institutions, such as:

- Transactions in minutes. A blockchain can speed up payments between banks by using a shared ledger to resolve delays that arise. Smart contracts can improve contractual term performance since they are only executed when certain conditions are met.

- Peer-to-peer transactions. Since blockchain removes the need for a trusted intermediary, it reduces operational costs for financial organisations.

- More transparency. All of the data contained in a blockchain is unchangeable and can be tracked in real-time. Having a detailed audit trail improves transparency across the industry.

JPMorgan, the biggest bank in the United States, introduced a digital currency called JPM Coin to help speed up the transaction process. China Construction Bank also has several blockchain projects in progress.

Blockchain and the retail industry

With products being sold from one part of the world to another, the retail industry encounters several problems. However, such issues can be resolved by blockchain technology:

- Crypto payments. Blockchain enables retailers to accept cryptocurrency payments, which make cross-border payments and micropayments easier. The use of smart contracts can allow instant payments, automated refunds, and much more.

- Supply chain transparency. Blockchain technology can be used to make sure that the products being sold come from authentic sources. It helps to build trust between a brand and its customers.

- Customer privacy. Customers currently share personal data with companies, and each company stores this information in its own database. Distributed ledger technology could improve personal data security.

In 2016, Walmart, a multinational retail corporation, ran a trial with IBM to trace the origins of produce with the help of blockchain. Samsung now uses blockchain technology to help parties prove their identity and execute agreements.

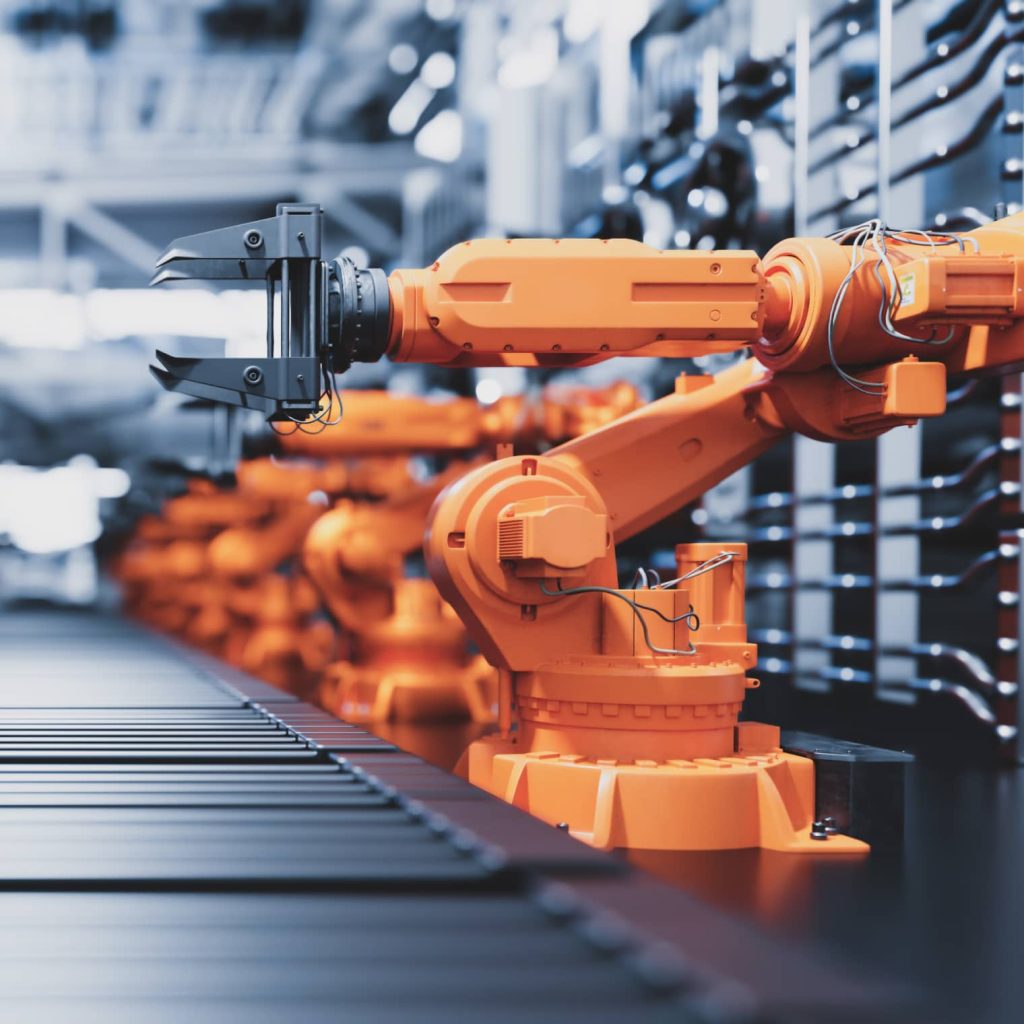

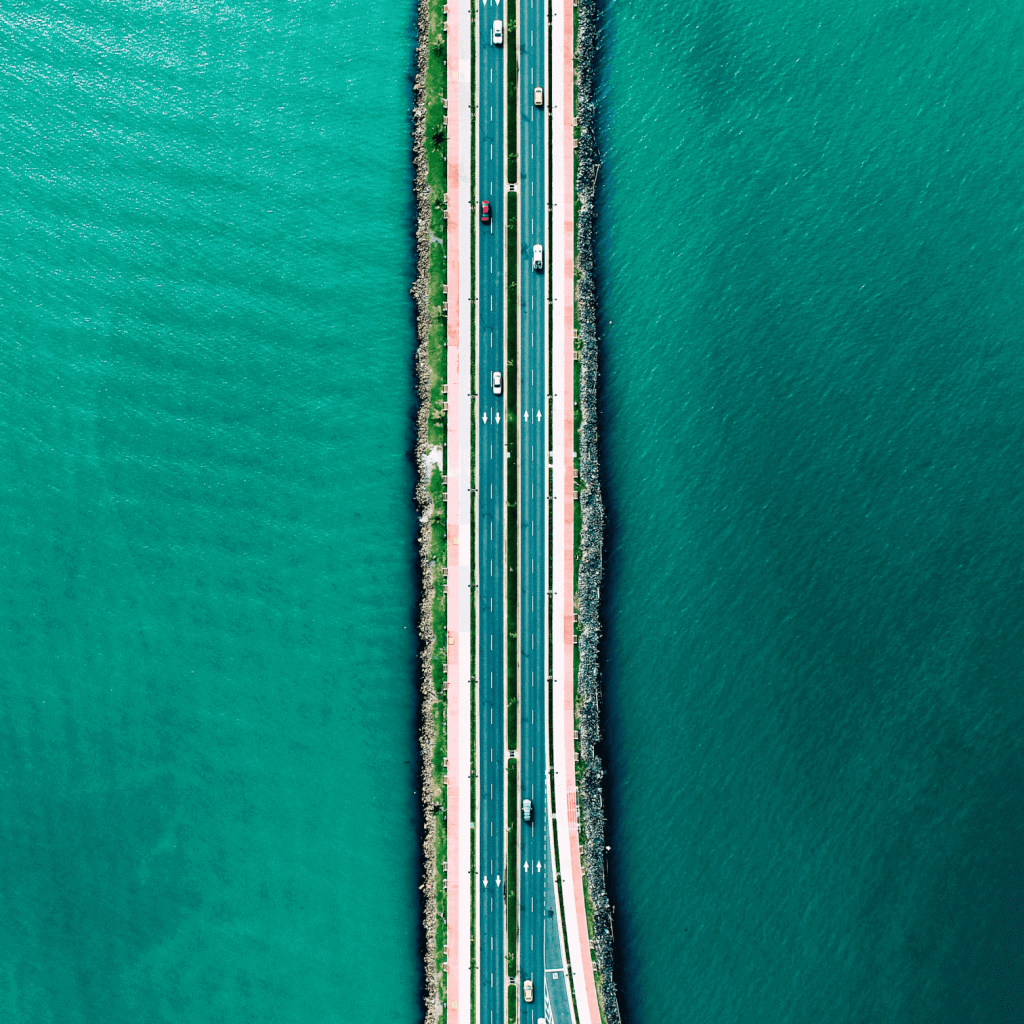

Blockchain and the logistics industry

The power of blockchain technology is fully leveraged in the logistics sector:

- Shipping efficiency. Blockchain technology can be used to improve the delivery process both locally and internationally; that is to say, with fewer errors, better delivery times, and a reduction in overall expenditure.

- Payment and transaction security. Blockchain can help improve invoicing and payments through an efficient and secure system. Smart contracts can be used to automate the whole process and make it error-free and transparent.

- Inventory tracking and settling disputes. Blockchain can help to track goods and to identify whether they have been misplaced or delayed—immutable data and real-time information about the cargo help to resolve disputes faster.

FedEx has already started to implement blockchain technology to track the movement of packages, and BMW uses blockchain to track materials, components, and parts across its supply chain.

Blockchain and the insurance industry

Traditional insurance companies have started to realise the digital effect as emerging technologies change the way consumers interact with businesses. Blockchain adoption could have many benefits for insurance companies, such as:

- Fraud prevention. A shared blockchain ledger would allow all insurers to know if a claim has already been paid, and identification of suspicious behaviour would also be easier.

- Reinsurance. Blockchain can streamline information flows between insurers and reinsurers. Sharing a blockchain ledger allows all parties to access the data simultaneously and takes away the need for reconciliation, saving time and money.

- Claims management. Storing insurance policies and claims on a shared blockchain ledger, which can be accessed by all insurers and reinsurers, could reduce the time and money spent on unprofitable activities.

Anthem, the health insurance company, has started using a blockchain-powered feature that allows patients to securely access and share their medical data.

Summary

With more and more entrepreneurs and businesses pushing the boundaries of innovation, all that remains to be seen is the extent to which blockchain will become part of our lives. And considering how strongly blockchain has developed in recent years, the future is likely to come much earlier than we think.

Contact us today to see how blockchain technology can drive performance and efficiency for your organisation.

Related Insights