Understanding how RPA works

RPA is typically applied to existing processes, utilising systems already in place. It is akin to a virtual workforce that handles transactions spanning multiple enterprise systems. RPA can capture data and manipulate enterprise apps just like humans do while making fewer errors.

Unlike older business process automation tools, RPA is capable of relying on AI technology solutions to help it learn along the way too. In other words, RPA is more flexible and more likely to stay functioning under changing circumstances.

Key benefits of robotic process automation in finance

As with many digital initiatives, cost reduction is a major driver behind the evolving role of robotics in finance, such as banking software, but cost is not the only factor. Companies looking to implement RPA in their finance functions can look forward to several benefits:

- Replace manual activities with little added value. Despite pervasive technology staff working in financial functions are still caught up in activities with little added value and low levels of subjective judgement. RPA can free staff up by automating these activities, so that staff can focus on high-value activities that require human discernment.

- Reduce human error. Manual processes inevitably invite the risk of error, errors which can have significant repercussions in the finance function. Robotics operating in finance functions are less error-prone, boosting customer satisfaction and sparing companies from large avoidable losses.

- Full audit trails. In today’s compliance-centric world companies need audit trails, but humans will never recall past events perfectly. RPA enables companies to thoroughly log every step in a process to enable rigorous auditing when required.

Typical RPA use cases

Finance is a meticulous, process-driven business function that is closely suited to the capabilities RPA brings to the table. Some of the typical applications for robotics in finance include:

- Day to day accounting. RPA can operate across accounting systems to enable bank reconciliation, automatically extracting general ledgers to reference against bank statements. Robots can even produce reconciliation statements in a predefined format.

- Investment management. Robots can serve as financial advisors on many levels and do so more cheaply than humans. RPA can help humans make better investment decisions including the construction of optimal investment choices. RPA offers faster, automated reporting that is actionable.

- Expense control. With receipts coming in all shapes and sizes, and with a thin line between reasonable expenses and the excessive humans can find expense accounting time consuming. Rule-driven robots can greatly speed up the expense control process and remove opportunities for poor judgement.

- Inventory management. Robots can automatically verify whether inventory has been received, automate the shipment process and perform accounting functions that reconcile inventory levels at year end.

We’ve highlighted just a few of the typical use cases for RPA in financial firms, and in the finance functions of all other enterprises. Again, wherever a repetitive process exists, chances are RPA can bring accuracy and cost savings to the table.

Integrating robotics in finance processes

We’ve already explained how getting started with RPA involves relatively low hurdles. Principally, RPA merely requires an existing process that is already documented. However, even where processes currently involve hiccups, a good technology consultant including a smart team of software experts can rapidly get you up and running. Get in touch with us!

Related Insights

The breadth of knowledge and understanding that ELEKS has within its walls allows us to leverage that expertise to make superior deliverables for our customers. When you work with ELEKS, you are working with the top 1% of the aptitude and engineering excellence of the whole country.

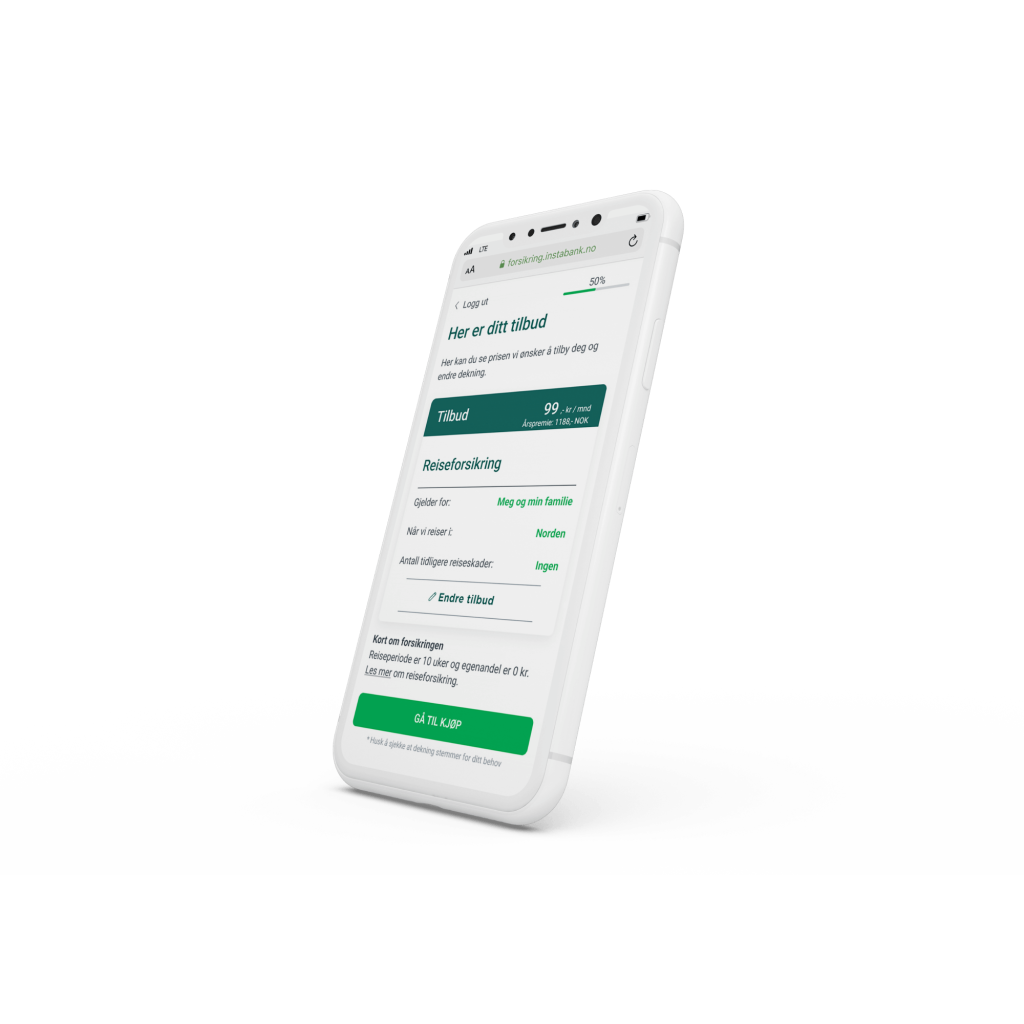

Right from the start, we really liked ELEKS’ commitment and engagement. They came to us with their best people to try to understand our context, our business idea, and developed the first prototype with us. They were very professional and very customer oriented. I think, without ELEKS it probably would not have been possible to have such a successful product in such a short period of time.

ELEKS has been involved in the development of a number of our consumer-facing websites and mobile applications that allow our customers to easily track their shipments, get the information they need as well as stay in touch with us. We’ve appreciated the level of ELEKS’ expertise, responsiveness and attention to details.