Understanding fintech and its impact on finance

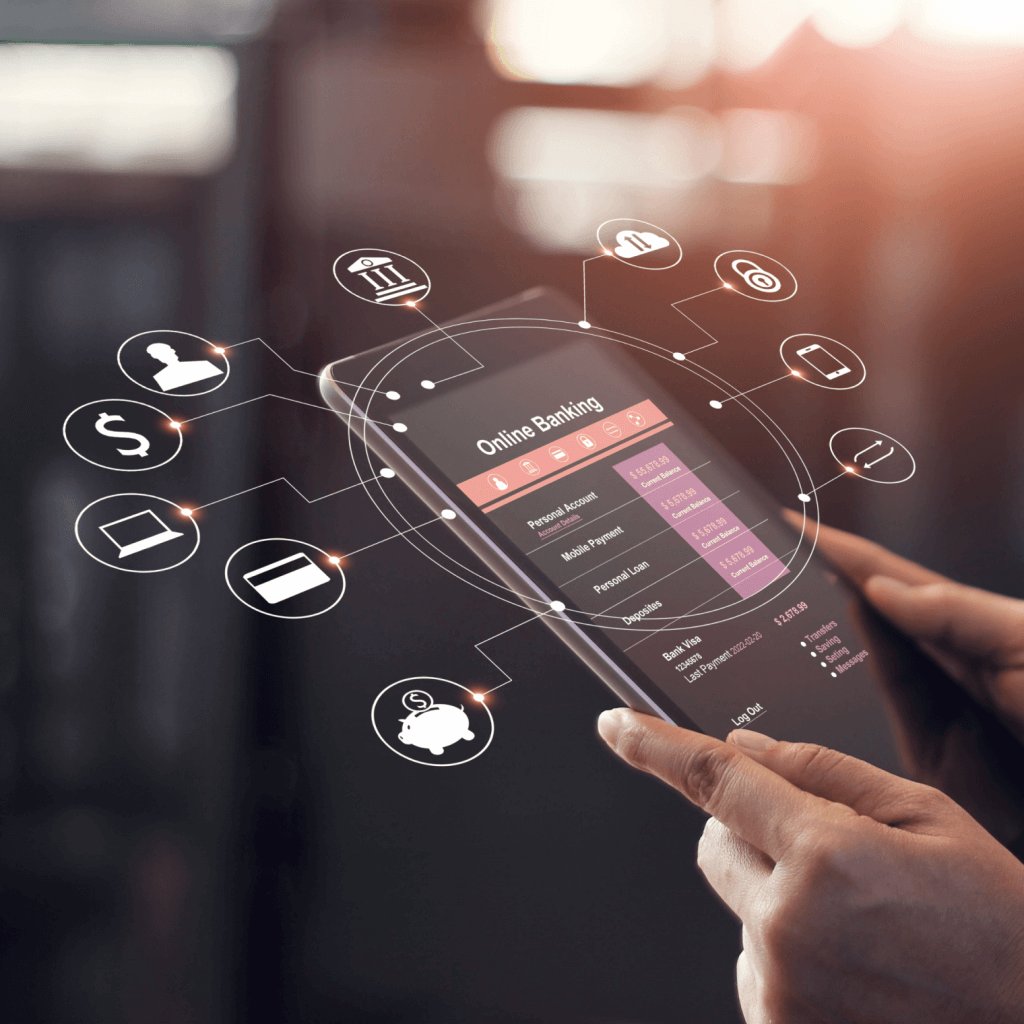

Fintech allows to digitise traditional banks’ financial operations, allowing users to open bank accounts or invest in financial products online. Moreover, with AI and machine learning technologies, financial institutions can now analyse larger amounts of data and provide more personalised services to customers.

This surge in fintech apps usage has been driven by growing demand for contactless payment apps and other digital banking tools necessitated by the pandemic. But it’s more than a passing phase; it reflects a profound shift in financial services industry.

To keep up with the pace of modern times, companies in the financial and banking sectors must incorporate scalability and flexibility into their operations. It will allow them to effectively adjust to a swiftly changing market landscape and evolving regulations. Let’s review top fintech trends that help enterprises to do so.

Seven fintech trends that look set to redefine the finance and banking sector

1. Digital-only banks

Digital banking is a popular and preferred method of money management for many—and has been since before the pandemic struck. But digital-only fintech solutions and services that negate the need to stand in lengthy queues at physical banking locations have gained real ground since.

Digital banking encompasses services like P2P transfers, cryptocurrency sales, digital wallets, contactless payments with free transfers, and international remittances. And big innovations in this area will continue to make it easier for people to take care of all their banking needs; anytime, anywhere.

As of 2022, 78% of Americans preferred conducting their banking activities through mobile applications or websites.

Arguably the most important aspect of digital-only banking, however, is its potential to reach a wider demographic than has ever been possible before. According to a recent World Bank report, there are still up to 1.7 billion people without access to the global banking system. So the significance of opening up access to essential financial services cannot be underplayed.

2. Public cloud

A report by the International Data Corporation (IDC) indicates that investment in public cloud infrastructure and services will have doubled between 2019 and 2023—with the banking sector accounting for roughly a third of spending.

Driving the move toward a cloud-based model is the growing prominence of open banking, which is gaining ground thanks to its ability to provide greater transparency. Agile fintech disruptors favour the cloud because it allows them to foster collaborative partnerships with developers. And large banks are now getting on board with the public cloud model because it supports a range of Platform-as-a-Service (PaaS) options.

Furthermore, operational challenges brought about by the pandemic mean that financial institutions and banks have little choice but to rely more heavily on cloud-based solutions from here on out.

3. Robotic process automation (RPA)

RPA has been adopted by a variety of sectors and, as a fintech solution, has the ability to streamline operations, reduce the human burden of repetitive tasks and greatly improve banking efficiencies. This will speed up and reduce the cost of many of the time-consuming back-end processes involved in running a financial institution, such as account maintenance, new customer onboarding and credit processing.

Moreover, automation can be harnessed to build a strategy for service excellence that sets financial institutions apart from the competition, including hyper-personalisation, true data integration and the ability to act on real-time insights to intuitively know what customers want.

If you would like to get more insights into the capabilities of RPA as well as its security vulnerabilities, check out this whitepaper: Top 10 Security Risks in Robotic Process Automation

4. Autonomous finance with AI and machine learning

Financial consumers are feeling increasingly time-pinched as they try to juggle home and work commitments with managing their personal finances. With AI and machine learning technologies, innovative fintech startups and businesses can automate financial decision-making and save their customers valuable time.

AI and ML are also enabling fintech firms to harness Big Data, to find meaningful patterns in customer behaviour that can lead to smarter financial decision-making. With this new intelligence, they can effectively tailor their products and services to match consumer desire.

Just as personalisation is becoming the expected standard across many other industries, like retail and healthcare, so to will it become the norm within banking. Other fintech applications of AI and machine learning include chatbots, trading algorithms, policy-making, fraud prevention, risk management and compliance.

5. Customer intelligence

Tying in with data science services, AI and machine learning, customer intelligence tools can be used conjunctively to harvest valuable insights from widely dispersed and oftentimes raw customer data. Fintech companies can use customer intelligence platforms to gather and analyse customer information including basic details, brand interactions, and customer survey data.

Furthermore, powerful linguistic analysis, language identification and pattern matcher annotators can garner a wealth of voice-indicative data from telephone conversations between customers and customer service call centres—most of which is unstructured and untapped. This technology can help brands understand a customer’s intention when they call, their behaviour, and their perception of the brand/product/service they’re calling about. In doing so, it will enable companies to better adapt their services to meet customer expectations.

6. Cybersecurity

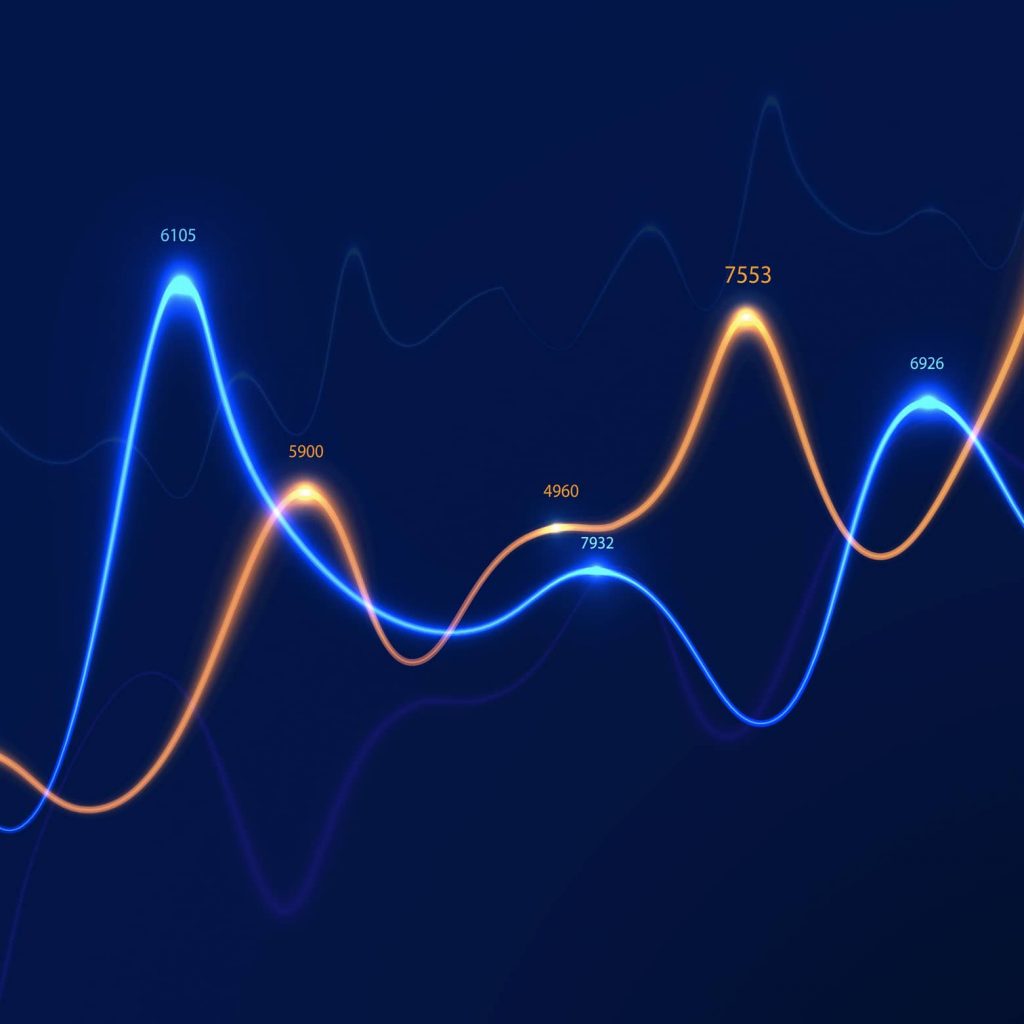

There is a rise expected in the global 'Estimated Cost of Cybercrime' from 2023 to 2028, with an estimated overall surge of $5.7 trillion. After experiencing compound annual growth rate for eleven years, this indicator is predicted to reach its highest point at $13.82 trillion by 2028.

The proliferation of IoT technologies across all industries, not least the financial sector, has created a wealth of new opportunities for cybercriminals to exploit.

Given the nature of the information held by financial institutions, it’s unsurprising that cybersecurity represents one of the biggest focuses for the sector moving forward. In fact, the financial industry is one of the top three targets for cybercrime, accounting for around 10% of all annual attacks.

According to a recent Deloitte report, up to 64% of banking businesses are expected to plough investment into combating cybercrime in 2021 and beyond.

7. Biometric security systems

With the aforementioned rise in cybercrime, the financial technology innovators are having to think of new and infallible ways to protect their customers’ sensitive financial data. Passwords are coming under increased pressure from evermore advanced criminal technologies, and this is why biometric security measures are the next logical step in safeguarding financial security.

Many are already familiar with things like fingerprint ID, but an increasing number of banks, including HSBC and First Direct, are looking to the trends in fintech like face and voice recognition to keep their customers safe.

This not only has the benefit of being far more secure than a password but it’s also much easier for the customer. Instead of having to remember endless combinations of letters and digits, and answer multiple questions to access things like telephone banking, they can gain access to their accounts simply by using their biometrics. It also benefits the banks by making authentication quicker and more efficient, and enabling them to remove certain human touchpoints.

The technology can be applied at cashpoints too, removing the need for a traditional PIN.

Conclusion

The finance and banking sectors are experiencing a transformative wave driven by innovative fintech trends. Financial institutions need to flex their models to support remote operations while adopting the latest fintech trends to innovate their offerings and enable tailored, on-demand banking services for the masses.

The integration of AI and machine learning technologies has paved the way for autonomous finance, allowing for automated decision-making and personalised services. The importance of customer intelligence tools in gathering and analysing dispersed customer data cannot be overstated, providing valuable insights to adapt services to meet customer expectations.

However, amidst these advancements, the financial sector faces growing challenges in cybersecurity, with an expected surge in the global cost of cybercrime. Thus, biometric security systems, including face and voice recognition, represent a crucial frontier in safeguarding financial data.

As we've covered in our article the fintech industry is dynamic, with several trends shaping its landscape. Here's brief overview of the key trends in the financial sector:

- Digital banking

- Artificial intelligence

- Cybersecurity focus

- Personalised financial services

The most commonly used fintech service can vary depending on geographical regions and user preferences. However, when considering a worldwide perspective, digital payment services and mobile wallets are extensively embraced.

The future of finance and banking will continue to be transformed by ongoing developments such as biometric verification, financial solutions enhanced by artificial intelligence, applications for neobanking, and the integration of finance into various platforms.

Related Insights