Technologies already played a key part in financial operations before the pandemic. However, many customers preferred traditional banking and visited their branches to conduct transactions. The coronavirus restrictions have greatly accelerated the shift towards digital transformation in banking and finance sectors. As a result, the global digital transformation market is set to expand from $469.8 billion in 2020 to $1,009.8 billion by 2025.

What is digital transformation in banking?

Digital transformation in banking involves applying innovative technologies – blockchain technology, artificial intelligence, process automation with a focus on decreasing manual workloads and others – to improve existing financial products and services. Digitalisation does not necessarily mean a replacement of traditional processes or legacy systems. On the contrary, financial corporations have several modernisation options to consider:

- Replatform – does not require major changes, involves version upgrades or minor changes to application functionality.

- Refactor – encompasses modernisation of the core codebase of a bank without altering baseline behaviour.

- Augment – introduces a parallel banking core system. This option can provide services that are not offered by the legacy core, aiming to migrate when the new core system is safe and steady.

- Replace – substitutes the legacy platform with new solutions.

However, digital transformation is not exclusively about technologies; it rather involves business enablers or what businesses can do with them. Rebuilding operations, procedures and relationships with customers are the essential purposes of digital transformation. To reach these goals, businesses often partner with technology companies providing financial software development services.

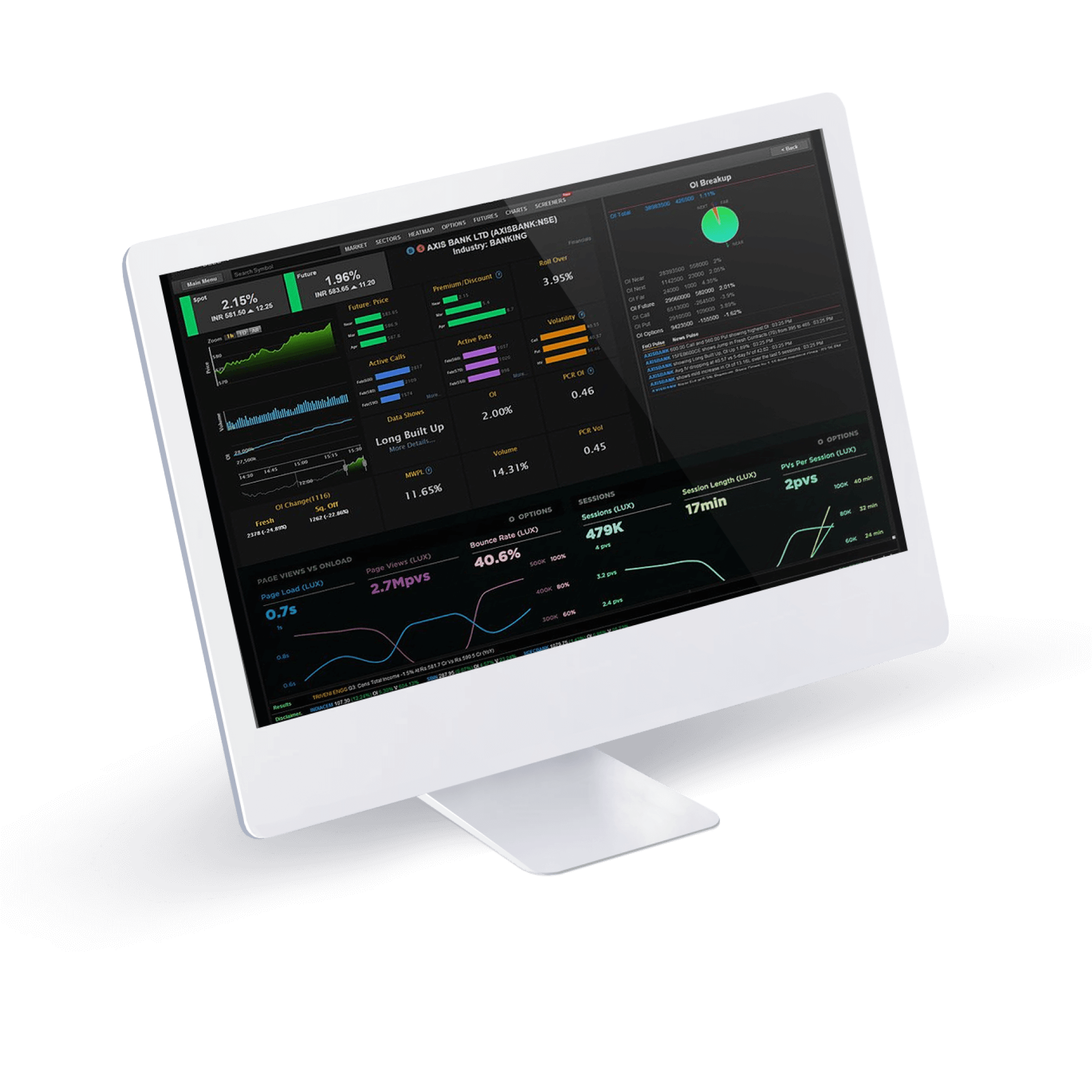

Here are some of the technology solutions that boost digital transformation in banking:

- Cloud computing

- Blockchain and distributed ledgers

- Cybersecurity

- Data analysis and privacy

- Digital channels

- Artificial intelligence

The basics of bringing digital transformation to banking

Start by mapping your customer journey and indicate what can be optimised with digital solutions. For instance, you might want to streamline the process of logging in to online banking applications by enabling biometrics-based authentication. However, keep in mind that technologies are only effective when supported by people and processes.

The modern banking customer prefers an omnichannel experience. Make sure you consolidate a connected set of databases within the organisation and look for opportunities to optimise business operations. This can lead to the creation of a new business unit or an entirely new digital banking division.

Be ready to move to a new business model, where the bank is more like a business platform. Platform banking is an online marketplace managed by a bank or another entity that offers banking and possibly non-banking services. Platformification improves the customer experience and allows the provision of services beyond a limited portfolio.

Digital transformation in banking: advantages and disadvantages

If you’ve ever checked your balance after making an online purchase, you’ve reaped the benefit of digital transformation in the financial sector. The digitalisation of the banking industry brings many advantages for customers, small and large companies, and banks. These advantages include:

- Streamlined acquisition of new customers. The Internet provides many opportunities to reach potential customers via their devices. An online presence driven by digital transformation boosts engagement and increases a company’s visibility.

- Remote access and 24/7 service. Brick and mortar banks limit the provision of their services to working hours. In contrast, a customer with an Internet connection has access to their online banking account round the clock every day, from any device and location. Digital solutions eliminate the need to visit a bank in-person to carry out operations such as changing an email address or checking transactions.

- Personalisation and customer experience. Technology-enabled analysis of customers’ preferences, demographics and other data allows banks to customise their services. Such tailored offers and products lead to an improved customer experience and better customer retention.

- Better efficiency. Replacing paper-based records with digital alternatives, like blockchain solutions, can facilitate processes and automate routine tasks. It reduces the costs of manual work. Moreover, since all information is stored within one network, it eliminates the possibility of duplicating the data.

Despite the many benefits, digital transformation in banking faces challenges, including:

- Poor implementation potentially causing breaches. If a digital initiative is not planned and tested enough, it can result in vulnerability or technical error that can disrupt the work of the whole financial entity. It can lead to information leaks and the loss of customers’ accounts and assets.

- Digital transformation being a time-consuming process. Changing your business operations is a multi-faceted process. Apart from adopting technologies, it involves constant investment in skills, projects, infrastructure, etc. Read more in our article about digital strategy pitfalls and how to avoid them.

Top use cases of digital banking transformation

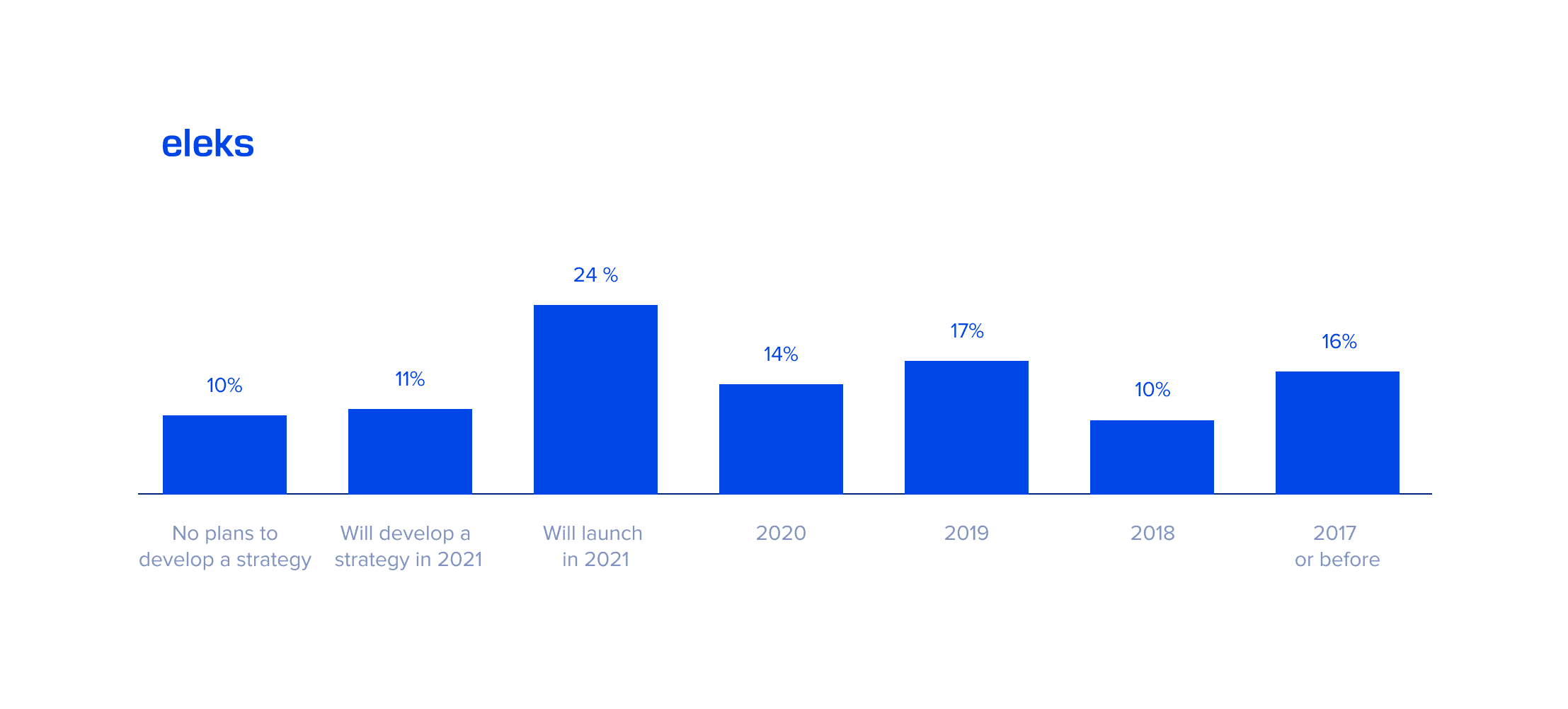

Many financial organisations have started their transformation, revealing plenty of the opportunities digital transformation presents. Here are some of the examples:

- Lloyds Bank. Lloyds Banking Group invested £4 billion in technologies between 2018 and 2020. Ongoing digitalisation has already helped the company to gain 17.4 million digital users, which is 30% more than before the pandemic. Additionally, the implementation of cloud computing allowed the company to reduce the time needed to introduce new features by 30%.

- Rabobank. A second-largest bank in the Netherlands has introduced RPA technology to streamline coronavirus-related loan modifications. The RPA-powered robot has saved the bank 50,000 working hours, and it is predicted that the overall number of hours saved will reach 100,000.

- Bank of America. In 2020, the bank’s customers deposited around 160 million checks via the company’s mobile app. At the same time, the bank’s AI-driven virtual assistant, Erica, helped handle more than 230 million requests, providing better digital experiences for customers.

Conclusions

With more and more customers turning to the digital world, banks must be there to provide seamless, secure and personalised experiences. By embracing digital transformation, financial institutions can modernise outdated processes and improve their bottom line by offering better customer services.

Related Insights