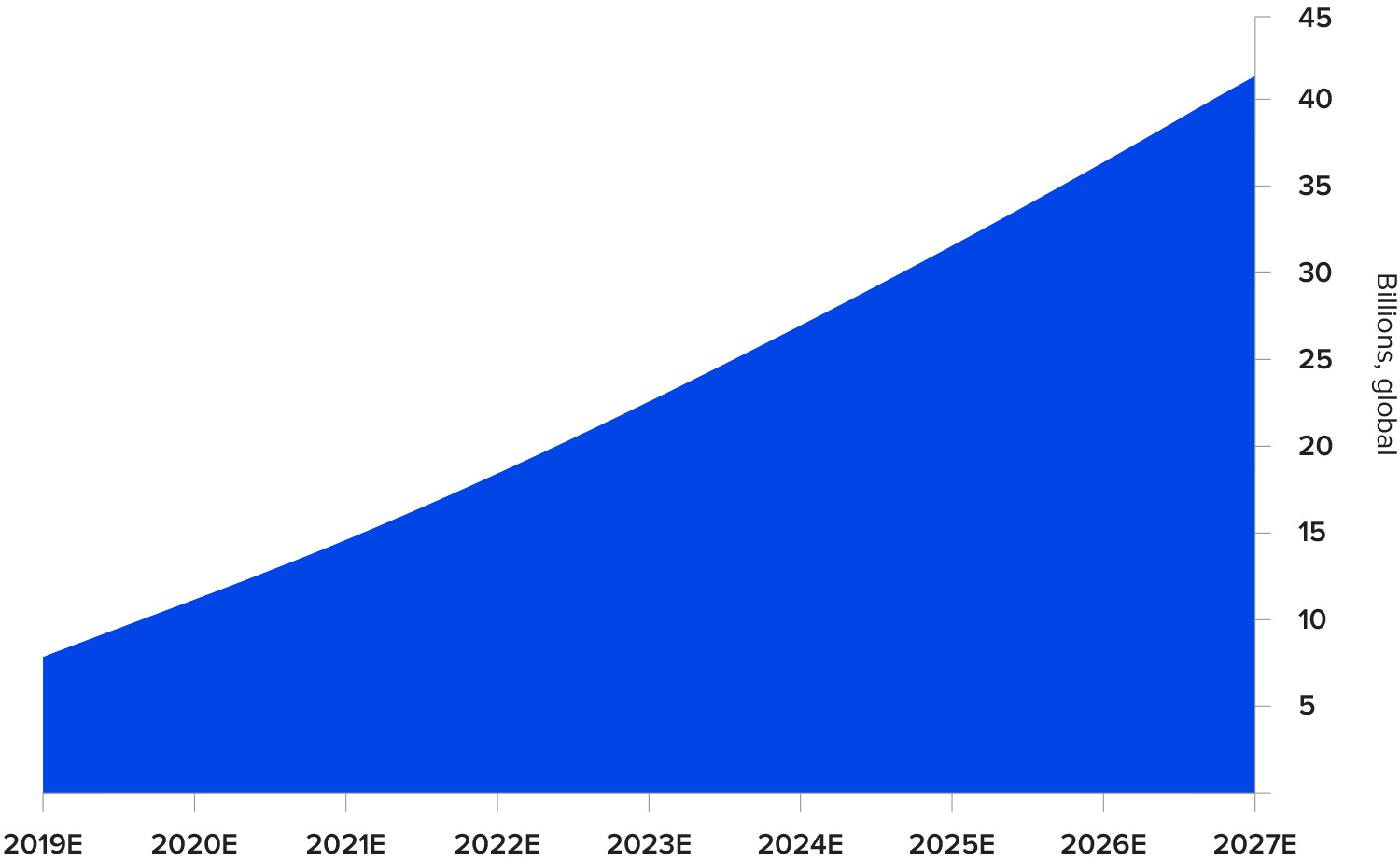

The number of connected devices, like vehicles, home appliances and wearables, is constantly growing. This multitude of Internet of Things (IoT) devices together become a new platform for purchasing goods and services. According to research by Mercator Advisory Group in 2019, the IoT payments segment has already amounted to $5.76 billion in payments and is estimated to grow to $7.56 billion by 2024.

Imagine your fridge ordering the food you need or your coffee machine ordering coffee beans when you’re running out. Your smart assistant can buy movie tickets by itself, schedule a doctor’s appointment for you or order a replacement for a blown light bulb. IoT solutions make all of these and other autonomous orders and payments possible.

IoT payments: what are they and how do they work?

IoT payments are data-driven actions performed by a device. In other words, a device orders certain goods or services with no human interaction required. The IoT technology powering such transactions is called tokenisation. It uses randomly generated number strings, or tokens, which are based on a real credit card or bank account number.

IoT payments offer a number of advantages; here are few of them:

- Extra convenience for end-users and growing demand for products and services, since orders created once a product is low on stock.

- Minimising physical contact, which is a necessity in these times of social distancing.

- Reducing time spent on payment-related activities: according to Visa, consumers spend nearly 32 hours per year on cash-related payment activities; the introduction of digital payment is projected to shorten the time up to 24 hours per year.

- The combination of machine learning and IoT payments can analyse consumer habits and preferences and suggest more personalised products.

Apart from tangible benefits, such payment innovations also raise a few concerns, and security is the most common one. However, a token can be traced back to the actual account number or card details only in the secure token vault – a centralised server. Until then, no information about the primary account number (PAN) owner is disclosed. Thus, IoT brings end-to-end payment encryption and minimises PAN exposure.

IoT solutions in the retail industry

IoT payments are transforming the way various businesses operate, and the retail sector is no exception. According to a study by PYMNTS and USA Technologies, nearly 50% of shoppers prefer unattended shopping experiences due to the amount of time they save.

Let’s take a closer look at some industry players leveraging the benefits of IoT payment solutions:

- Amazon Go. Amazon has become one of the leading IoT players. Unlike other brick-and-mortar stores, Amazon Go is a connected store with no checkout. You can grab the items you need and walk out of the store without checking out; the payment will be made automatically. The store functions together with the Amazon Go application, creating a virtual cart with your products. The technology, powered by computer vision, sensor fusion and deep learning, can easily recognise the products you’ve picked or returned. So after you leave the store, your Amazon account is automatically charged and you receive the receipt.

- 7-Eleven. 7-Eleven, another of the largest chains in the retail industry, has announced that it is testing a cashier-less store model. The whole concept is similar to that of the Amazon Go stores. 7-Eleven’s unattended store will involve an app to check into the store, pay for products and obtain receipts.

- Caper. The AI-powered shopping cart producer has introduced another option for autonomous retail. Caper has developed a shopping cart with a built-in barcode scanner, credit card swiper, image recognition cameras and weight sensors. The technology allows store visitors to pay on the cart and leave the store once they are done.

- Samsung. Samsung’s Family Hub has taken the shopping experience to a new level and integrated payments into the fridge. It allows users to purchase groceries or order takeout while standing in their kitchen.

IoT opportunities in the automotive industry

The majority of cars are manufactured with built-in Internet capabilities and connectivity. Statista reports that nearly 28.5 million connected vehicles were sold in 2019. Connected vehicles are becoming an evolving trend in the IoT payments sector.

In-car payments powered by IoT technology allow consumers to make transactions without cash or credit cards, which ensures a safe and secure environment for customers during the pandemic and beyond.

Visa, for instance, has described how IoT transactions can streamline the process of refuelling your car. The connected car can locate the petrol station on its own, pay for gas and turn the pump on before you get out of the vehicle. All you’ll have to do is pump.

Honda has collaborated with Visa, Mastercard and PayPal to enable in-car payments. The automotive sector player has presented a suite of apps called Honda Dream Drive, which allows you to make restaurant reservations, purchase items and pay for other things like parking, movie tickets and fuel via the car’s navigation system.

Another evolving trend among car manufacturers is a car subscription model. A vehicle-subscription program is an alternative to owning or leasing a car by paying a monthly fee. For example, Volvo has introduced a subscription that covers vehicle usage, maintenance, and other ownership-related services. Tesla announced that a full self-driving (FSD) package would be available as a subscription service. A connected vehicle can acquire an additional feature as soon as it’s released without physically going to the shop to check the updates.

The importance of IoT to the finance industry

With more customers making payments via smart home appliances and wearables, IoT has the ability to transform financial institutions digitally. The cooperation of banks with IoT players (such as Uber and Apple) and payment systems (Visa, Mastercard and PayPal) presents considerable financial opportunities. The IoT players will stay present in fintech operations, and the payment systems won’t have to build new financial infrastructure.

Most financial institutions are still involved in the majority of financial operations as providers of credit cards or holders of bank accounts. However, IoT payments can include non-bank players like Amazon, and this is when customers can migrate. Thus, the IoT application will help banks and credit unions to win customers back since traditional banking institutions provide a major advantage when it comes to IoT payments, which is trust.

Summary

IoT payments have the power to change the payment landscape and our everyday routines. The retail, automotive and finance industries are not the only sectors in which IoT payments can be applied. Let’s imagine these two concepts:

- Smart city. A cashless city – a place where you can pay for services like public transport and parking without using your wallet.

- Smart house. An IoT-powered home that can automatically take care of payments for utilities and orders for supplies.

IoT payments are paving the way for a shift from imagining a cashless society to living in one. If you are considering an IoT solution for your business, we can help you meet any gaps in your in-house skillset. Our smart team of software experts can join you at whatever stage you are in your digitalization journey.

Contact us today to enable new payment innovations and stay ahead of the market.

Related Insights

The breadth of knowledge and understanding that ELEKS has within its walls allows us to leverage that expertise to make superior deliverables for our customers. When you work with ELEKS, you are working with the top 1% of the aptitude and engineering excellence of the whole country.

Right from the start, we really liked ELEKS’ commitment and engagement. They came to us with their best people to try to understand our context, our business idea, and developed the first prototype with us. They were very professional and very customer oriented. I think, without ELEKS it probably would not have been possible to have such a successful product in such a short period of time.

ELEKS has been involved in the development of a number of our consumer-facing websites and mobile applications that allow our customers to easily track their shipments, get the information they need as well as stay in touch with us. We’ve appreciated the level of ELEKS’ expertise, responsiveness and attention to details.