Over the last 10 years, regulated industries, including finance, have suffered through unprecedented increases in the cost of regulatory compliance, spending as much as $270 billion globally in a single year. Increased public pressure, internal pressure from leadership, and new, more complex regulations are putting a strain on people-based systems, forcing companies to spend money on outside consultants and professional services to meet compliance demands.

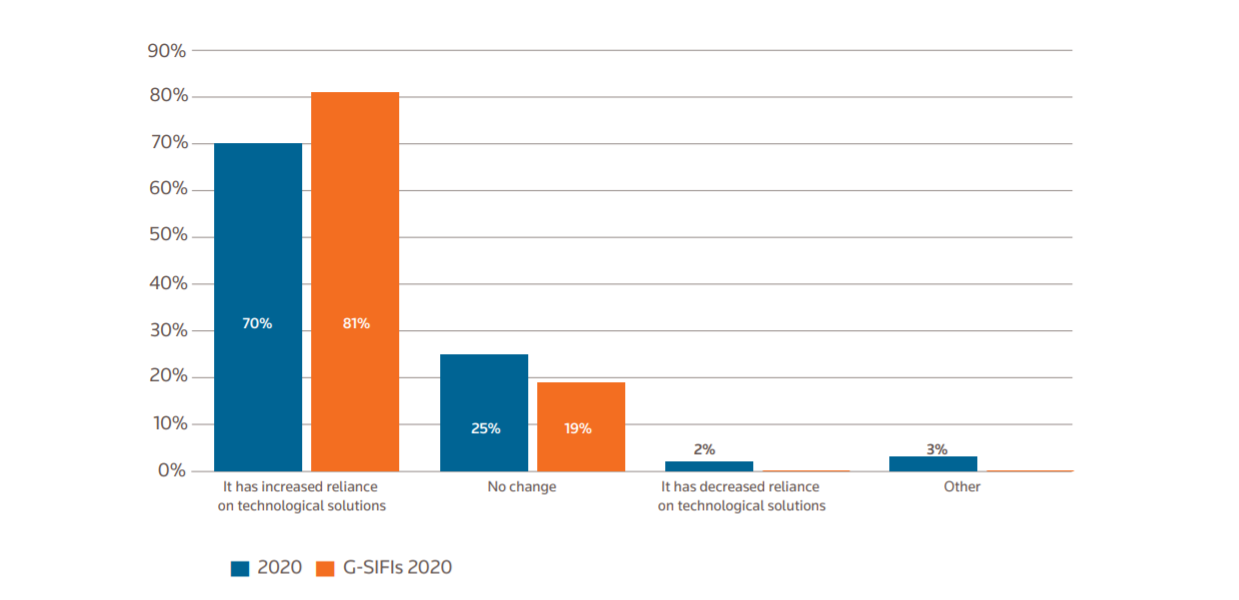

2020 has brought many regulatory changes — COVID-19 paid leaves, renewed safety policies and procedures, digitization of business processes and transition to the remote work environment. It has also spurred the number of financial crimes and risks of market abuse. For small and medium market players, examining their compliance process has become even more crucial and challenging. Meanwhile, the trend of adoption and use of regulatory technologies has continued to grow.

What is RegTech?

Forrester describes RegTech as “the technology-enabled transformation of the compliance function” via “specialized software for specific compliance use cases across various highly regulated industries.” Just as companies digitally transform and “future proof” operations, analytics, and the customer experience, RegTech enables them to apply the same philosophy to compliance.

RegTech is already paying dividends for leading companies, helping them improve risk mitigation and better protect their customers even while reducing the fixed cost of compliance over time.

Companies invested $1.37 billion in RegTech in the first half of 2018—more than in all of 2017—and investments are growing as the technology performs. Forrester predicted spending in this category would double in 2020, having grown 103% year-over-year in the first three quarters of 2019.

The interest towards RegTech solutions have only increased during 2020’ shifted business environment and, according to KPMG, RegTech investments reached record highs in 2020 with over $10 billion.

The cost of non-compliance in Finance has become unmanageable

Financial and data security are of paramount importance to government software and consumers as well as companies—so much so that in 2020 regulators imposed more than $14 billion in fines on banks globally with the most common violation being AML breaches.

For firms still using paper-based or older digital systems for compliance, their very survival is at stake. Fifteen to twenty percent of banks’ operational costs already go towards governance, risk, and compliance, Bain & Company estimates; since these older banking software systems cannot scale, hiring more staff is the only option these companies have. Compliance staff spending has already doubled in the past six years, rendering this strategy unmanageable—especially as regulations continue to change.

Over 50,000 regulatory updates were published in 2015 alone, 100% more than in 2012. The volume and speed of regulatory change is only increasing, and companies are already spending between $1 million and $5 million on compliance for every $1 billion in revenue, PwC reports. Practically speaking, these costs alone—and not just a desire to innovate—will fuel RegTech adoption for years to come.

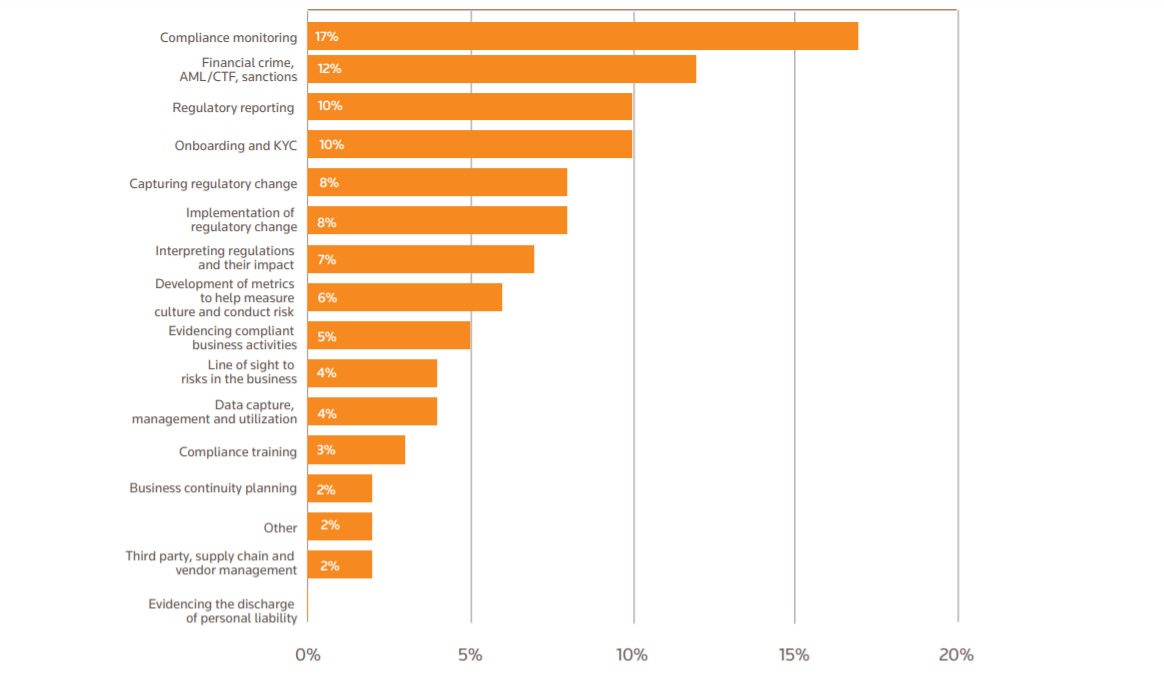

Facing down the most challenging aspects of compliance

Organizations’ compliance leaders are already under pressure from executives to reduce costs and risk; increasingly, they are called on to leverage compliance data strategically, adding business value in other areas as well. Rather than invest in more solutions, compliance professionals can use RegTech to reduce capital investments, streamline compliance, and add flexibility to meet changing demands. According to International Monetary Fund’s report, a company has decreased compliance cost from £18 million to £0.5 million annually by applying the RegTech solutions. There are several examples of successful RegTech use cases and capabilities:

- RegTech have increased the accuracy of regulatory reporting by 47% and also can simplify reporting for regulatory purposes, for example. It eliminates the gaps that exist between the intended purpose of regulations and firm’s interpretations of those regulations, which are prone to human error.

- Like other FinTech solutions, RegTech allows for better decision-making based on firms existing data, which adds business value outside of compliance reporting alone.

- Most importantly, RegTech positions firms for long-term innovation—a critical feature as regulations and business needs continue to change.

It’s in this space that the ‘thinking’ technologies of today's technology landscape—such as artificial intelligence (AI), machine learning, natural language processing (NLP), and blockchain ledgers—will enhance RegTech capabilities and make it a mission-critical investment for all financial firms. Adapting to changing business and regulatory requirements without these technologies and remaining competitive simply won’t be possible.

By 2020, RegTech had been projected to make up 34% of all regulatory spending. By 2025, the spending on RegTech will exceed $130 billion in comparison to $33 billion in 2020. That’s because RegTech is already living up to its promise: scaling to meet any regulatory requirement, mitigating risk, and even getting ahead of potential concerns. In time, RegTech will provide competitive value for companies that invest in it, allowing them to keep up with regulatory changes quickly while people-based systems lag behind.

RegTech 3.0—from business expense to “business enabler”

“RegTech is the answer to a real need. Learning, interpreting and complying with voluminous regulation requires the financial services industry to spend great resources. And RegTech has the promise of making that process more efficient and cost-effective.”

The advancement in blockchain technologies is one of the main drivers in the RegTech revolution. RegTech powered by cryptographic technologies can help financial institutions to address vulnerabilities regarding AML and KYC compliance regulations during client onboarding. The universal blockchain-based database has the potential to allow instant validation and confirmation of the documents for AML reporting and immediate data authentication for KYC obligations.

The latest RegTech solutions use emerging technologies like advanced analytics, robotic process automation (RPA), and even artificial intelligence (AI) to optimize compliance and facilitate a workable, evolving model that scales and adapts with minimal internal friction.

In this way, companies can adapt to meet any compliance need—such as automating corporate governance, keeping up to date on regulatory changes, and minimizing human error—but also deliver value where it's least expected. RegTech has the potential to provide valuable business insights, improve and accelerate customer experiences, and even drive new products and services. These new applications embody the next stage of RegTech transformation—“RegTech 3.0”—which is characterized by 'a move away from 'know your customer' to 'know your data,' where RegTech is no longer a business expense but a 'business enabler'.

Financial service companies can only capture this value with the right application or RegTech. When decision makers identify use cases where RegTech can be deployed quickly and quickly take hold—use cases where technology can have the greatest impact on workflow and reporting—they position themselves to realize the long-term benefits of this transformative and essential step in their companies' digital transformations.

ELEKS has over 28 years of experience delivering software solutions for businesses in highly regulated industries, including finance, healthcare, government, energy, and others. We understand the compliance risks you face, and we understand how to meet those evolving challenges with the right technology investments for your firm.

Contact us today to start a conversation about RegTech for your business.

Related Insights

The breadth of knowledge and understanding that ELEKS has within its walls allows us to leverage that expertise to make superior deliverables for our customers. When you work with ELEKS, you are working with the top 1% of the aptitude and engineering excellence of the whole country.

Right from the start, we really liked ELEKS’ commitment and engagement. They came to us with their best people to try to understand our context, our business idea, and developed the first prototype with us. They were very professional and very customer oriented. I think, without ELEKS it probably would not have been possible to have such a successful product in such a short period of time.

ELEKS has been involved in the development of a number of our consumer-facing websites and mobile applications that allow our customers to easily track their shipments, get the information they need as well as stay in touch with us. We’ve appreciated the level of ELEKS’ expertise, responsiveness and attention to details.