Personalized banking – a new level of customer experience enabled by technology

According to Salesforce, 72% of consumers and 89% of business buyers expect companies to understand their unique needs and expectations, while 66% of consumers say they’re likely to switch brands if they feel treated like a number, not an individual.

Most consumer banking systems are highly commoditised and it’s impossible for banks to dedicated countless staff hours to offer highly personal banking experiences, except for the VIP cases. Yet technology can enable greater personalisation of commodity services such as banking in many different ways, including:

- Holistic customer view. Tech enables large, complex institutions like banks to develop a single view of a customer that persists across the organisation. With the right tech in place every department in a large financial institution possesses deep, comprehensive insight on any given customer – delivering messages and services that are representative of all retained customer knowledge.

- AI-driven customer insight. Cutting edge tech including artificial intelligence (AI) and machine learning can take this holistic customer view and draw deep insights which deliver highly personalized banking experiences. Banks can use AI and apply data science models to continuously learn about each client, constructing a deep understanding of their customers.

- Open banking initiatives. Drawing a comprehensive customer picture often involves data that lies outside of an single institution’s boundaries. Open banking initiatives such as PSD2 allow institutions to share data about customers which in turn means that personalisation can pivot off a more comprehensive picture of the customer.

Technological innovation is driving change in retail banking, including an emphasis on personalisation – banks must keep pace with this change or risk losing customers to fintech challengers, or face getting cut out altogether as technology enables disintermediation.

BCG estimates that for every $100 billion in assets that a bank has, it can achieve as much as $300 million in revenue growth by personalizing its customer interactions.

Transforming the way banks interact with customers

By 2023, the majority of organizations using AI for digital commerce will achieve at least a 25% improvement in customer satisfaction, revenue or cost reduction, Gartner says.

Personal banking service delivers a better customer experience across human and digital channels. Here’s how:

- Marketing with focus. Consumers face a gulf of marketing and will quickly tune out messages that are not relevant. Personal banking that’s enabled by technology ensures that institutions do not become part of the noise by reducing the degree of irrelevant offers. Instead, personal banking delivers highly relevant, effective marketing that grows the customer relationship.

- Enabling omnichannel. Though retail banking is less and less branch-based customers still interact with their banks across multiple channels – including the branch. Technology helps banks deliver relevant, personal services irrespective of the channel a customer prefers at any given point in time.

- Recommended actions. Financial services can be a challenging topic for many consumers. Tech helps banks drive recommendations, including suggested next best actions that guide consumers through their complex financial affairs. In doing so institutions retain customers while building a greater degree of trust.

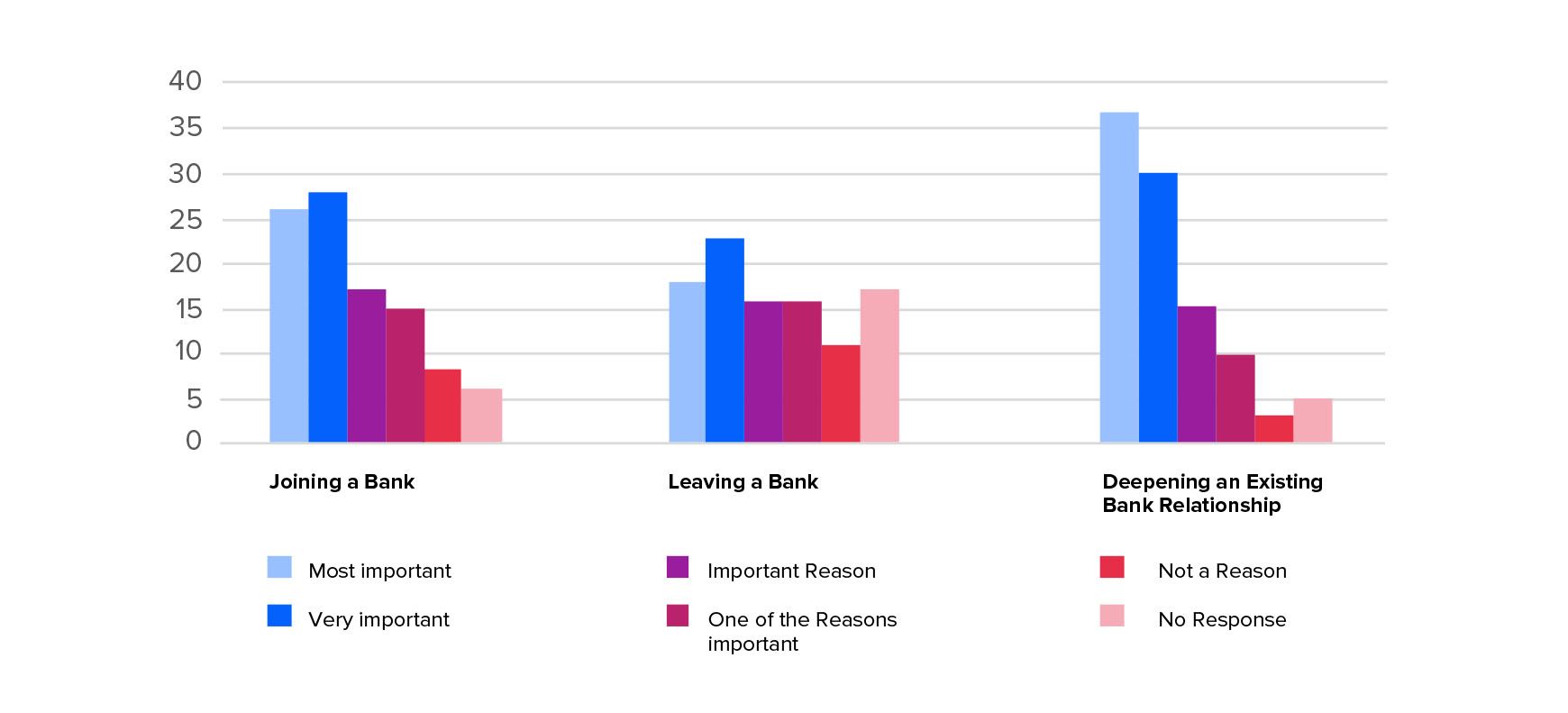

Consumers may rarely change banks. Nonetheless they frequently interact with their banks. A bank stands to lose substantially if and when customers decide to switch. Furthermore, banks that can build a reputation for personalized banking will enjoy big wins as new customers sign up thanks to referrals.

Personalisation vs compliance and security

There is, however, a real hurdle when it comes to rolling out personalised retail banking. A tightening compliance and security environment makes the level of data sharing and processing required by personalized banking much more challenging than it would otherwise be.

And, of course, the most personal banking service in the world can quickly be undermined if consumers fail to trust a financial institution. Banks need to remain cognizant of three key areas:

- Data sharing can expose institutions to cyber threats, banks should beef up cybersecurity to ensure open banking does not result in data loss.

- Throughout driving individualised banking services institutions need to stay on the right side of compliance law.

- In the journey to more personal banking institutions should be careful to not get to the point of invading induvial privacy.

That said, with the right measures in place banks can deliver incredibly personal experiences without exposing consumer’s trust to any degree of risk.

At ELEKS, we have assisted countless financial institutions, including banks, to make the best use of digital innovation. Get in touch with us to find out how we can harness Data Science and latest fintech trends to deliver a more personal banking experience across your customer base.

Related Insights

The breadth of knowledge and understanding that ELEKS has within its walls allows us to leverage that expertise to make superior deliverables for our customers. When you work with ELEKS, you are working with the top 1% of the aptitude and engineering excellence of the whole country.

Right from the start, we really liked ELEKS’ commitment and engagement. They came to us with their best people to try to understand our context, our business idea, and developed the first prototype with us. They were very professional and very customer oriented. I think, without ELEKS it probably would not have been possible to have such a successful product in such a short period of time.

ELEKS has been involved in the development of a number of our consumer-facing websites and mobile applications that allow our customers to easily track their shipments, get the information they need as well as stay in touch with us. We’ve appreciated the level of ELEKS’ expertise, responsiveness and attention to details.