Hedge Funds & Asset Management

What you get with our custom asset management software

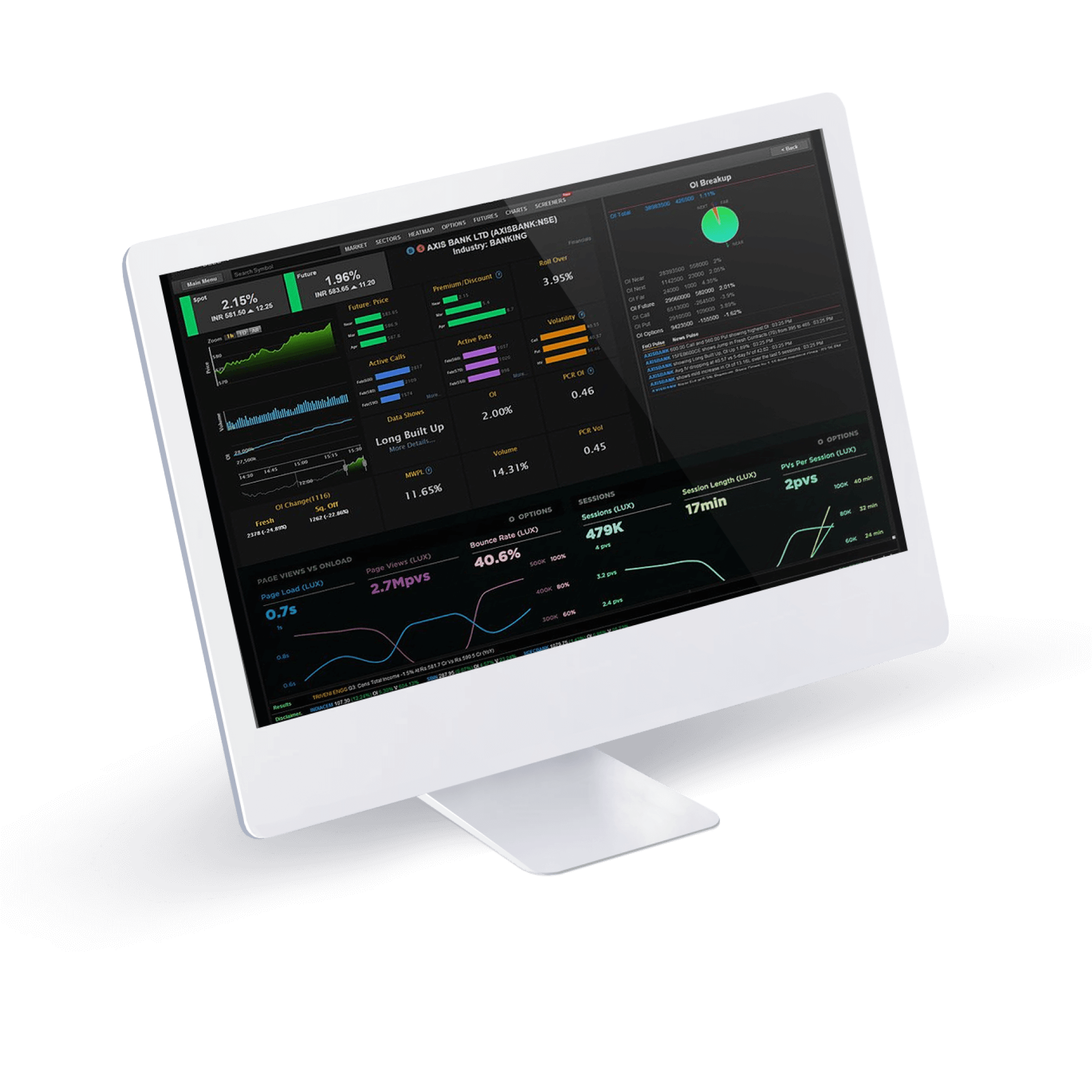

ELEKS' tailored data-driven asset management software for hedge funds enables fund managers to seamlessly execute complex trading algorithms, portfolio management, and risk analysis. Our advanced investment industry solutions minimize latency and slippage, ensuring improved financial transaction performance and real-time data processing to swiftly respond to market changes and secure successful trading outcomes.

With robust cybersecurity measures and compliance with industry-specific regulations, our custom-built solutions safeguard sensitive financial data, proprietary algorithms, and client information. Our software integrates data science and analytics tools for comprehensive risk assessments, helping fund managers make smarter decisions and improve risk management strategies.

With features like real-time position tracking, P&L (Profit and Loss) analysis, risk attribution and more, our custom portfolio management software streamlines hedge fund operations and helps fund managers optimise portfolios in line with their organisation's investment strategy and objectives.

With the help of our custom trading execution platforms, hedge funds can execute complex trading strategies, such as algorithmic and high-frequency trading (HFT). In doing so, hedge fund managers can seamlessly carry out trades while minimising market impact via various asset classes and trading venues, advanced order types and smart routing algorithms.

Our custom-built accounting and fund administration software streamlines back-office operations by automating tasks like trade reconciliation, NAV calculation and investor reporting. Thus, hedge fund administrators can guarantee the accuracy of their fund expense accounting, management fees and investor capital allocation.

Hedge funds can benefit from our advanced liquidity management software to easily assess daily liquidity needs and optimise cash flow. We build all types of custom liquidity management solutions that help global fund managers maintain sufficient liquidity to meet investor redemption requests while minimising cash drag on returns.

ELEKS’ fintech experts can help you design and implement data-driven expense management and reporting tools to track and categorise your fund's expenses and analyse cost structures. And, with this detailed picture, hedge fund managers can optimise their clients’ expenses and boost profitability.

With advanced risk management software tools, hedge fund managers can effectively assess and quantify the risk exposure of a portfolio and make informed decisions to protect capital. We offer custom data-driven solutions that employ advanced risk models like Monte Carlo simulations and scenario analysis to measure potential losses, stress test portfolios and calculate VaR.

ELEKS’ custom compliance and regulatory reporting software helps hedge funds ensure adherence to all current relevant financial policies and regulations whilst effectively managing investor disclosures and due diligence. We offer smart data-driven tools, including a compliance automation platform, that allow fund managers to run compliance checks, track regulatory changes and generate any reports required by authorities such as the SEC, CFTC, and ESMA.

Customer feedback

The value of ELEKS’ custom asset

management applications

Designed to align with hedge funds’ niche investment strategies, ELEKS’ custom software solutions for asset management help fund managers seamlessly execute complex trading algorithms, portfolio management and risk analysis activities critical for success in the financial markets, whatever method they choose.

Latency can have a huge impact on trading outcomes. So we create advanced investment industry solutions that help asset managers minimise latency and slippage. Furthermore, hedge fund software offers real-time data processing that helps managers swiftly respond to market changes, boost their efficiency and secure successful trading outcomes.

With masses of sensitive financial data around clients, trading strategies and proprietary algorithms, hedge funds can really benefit from custom-built solutions that enable robust cyber security via encryption, access controls and authentication while also safeguarding industry-specific regulatory compliance, such as SEC or CFTC regulations.

Our custom hedge fund software integrates data science and analytics tools that allow fund managers to perform comprehensive data-driven risk assessments, make smarter decisions and substantially improve their risk management strategies through advanced risk models, Monte Carlo simulations and stress testing capabilities that give deep insights into portfolio risk exposure.

Hedge funds often need to rapidly scale and adjust to a growing volume of assets, asset classes and larger portfolios. We build custom software flexible enough to accommodate this growth thanks to scalable architecture and performance optimisation tools for asset management that don’t compromise efficiency.

ELEKS’ custom asset management software empowers hedge fund administrators to create and implement proprietary trading algorithms and analytics models to gain a significant competitive advantage. Administrators can identify potential trading opportunities faster, manage risks more effectively and optimise strategies to flex to a changing market and see better financial outcomes.

What’s included in our custom hedge fund software development services?

-

Research and consulting

Our custom hedge fund and asset management services begin with deep-dive research and consulting, during which our experts get to grips with your hedge fund’s specific needs and goals. We then carry out in-depth market research and analysis to spot trends, opportunities and any potential obstacles which might impact the solution’s development process. In getting to know your needs and the opportunities available, we ensure that the asset management software solution you get is the best fit for your business objectives and portfolio management strategy.

-

Business analysis and requirements management

Next, we move on to a comprehensive analysis of your business operations, trading workflows and regulatory requirements, in order to crystalise your project’s requirements. Working closely with your stakeholders, our trading software developers capture the finest details to ensure that the software developed meets every one of your criteria.

-

Custom hedge fund software solutions

Deploying the skills of our leading fintech experts, we create advanced hedge fund solutions that meet your organisation’s niche challenges and requirements, optimising your operations and efficiencies while giving you the best shot at success in the ever-changing financial markets.

Our customer success stories

Hedge funds & asset management FAQs

Hedge funds and asset management software is used to aid complex investment operations, from portfolio management and risk analysis to trade execution and regulatory compliance. The software handles essential functions including real-time position tracking, profit and loss analysis, automated trade reconciliation, NAV calculations, and investor reporting. Hedge fund administrators can create and implement proprietary trading algorithms and analytics models, identify potential trading opportunities faster and manage risks more effectively.

Hedge funds and asset management software automates manual processes, reduces costs, and enhances investment performance outcomes. It also allows users to minimise latency and slippage in trading operations. Advanced analytics enable better risk management strategies and portfolio optimisation. Financial institutions can benefit from lower operational costs, improved regulatory compliance, increased data security, and the capacity to scale their operations.

Essential features include portfolio management tools with real-time position tracking, risk management capabilities, and automated trading execution functionality. Additionally, hedge funds and asset management software can include data analytics and visualisation tools, compliance monitoring and reporting systems, secure data management capabilities.

The breadth of knowledge and understanding that ELEKS has within its walls allows us to leverage that expertise to make superior deliverables for our customers. When you work with ELEKS, you are working with the top 1% of the aptitude and engineering excellence of the whole country.

Right from the start, we really liked ELEKS’ commitment and engagement. They came to us with their best people to try to understand our context, our business idea, and developed the first prototype with us. They were very professional and very customer oriented. I think, without ELEKS it probably would not have been possible to have such a successful product in such a short period of time.

ELEKS has been involved in the development of a number of our consumer-facing websites and mobile applications that allow our customers to easily track their shipments, get the information they need as well as stay in touch with us. We’ve appreciated the level of ELEKS’ expertise, responsiveness and attention to details.