The challenges facing the automotive industry

A wave of technology and growing concern about the environment is challenging the status quo throughout the automotive sector – affecting car manufacturers, the supporting supply chains and everything in between. These are several automotive trends that are shaping the industry and automotive technology innovation is perhaps the biggest instigator of change.

IoT and 5G drive pervasive connectivity, boosting a steady march to autonomous driving, with advanced driver-assistance systems (ADAS) already a common in-car feature. And it’s not just in-car technology that is imposing change, the mobility revolution plus tech trends including AI and machine learning has meant that cars are used differently. Furthermore, technology has changed the competitive map: with tech-first car manufacturers now disrupting a market previously dominated by established brands.

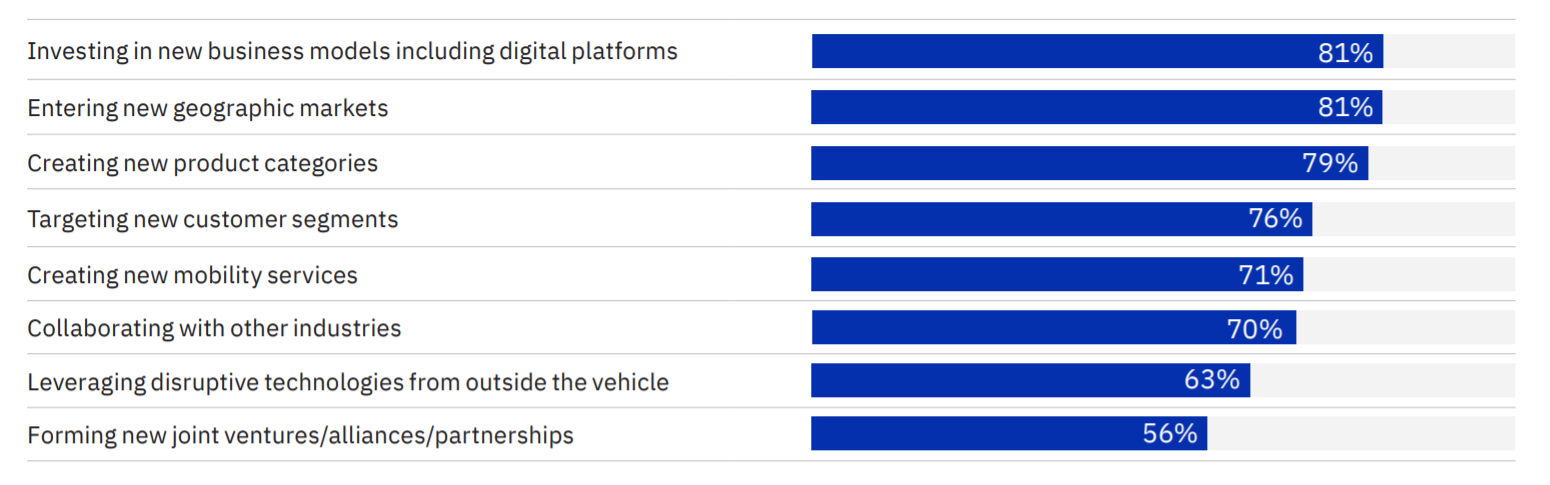

The Automotive 2030 Executive Survey conducted by IBM reveals that for automotive businesses to differentiate their brands,

technology innovation continues to be of top importance. The major value creator will be the customer experience and digital initiatives, which will help automotive businesses to boots their brand value. In fact, 80% of surveyed executives expect customer experiences to be greatly enhanced by digital services.

Other factors include changes in global supply chains, shorter technology cycles and of course pressure from environmental regulations. It all makes for a complex mix of challenges that auto industry players are learning to adapt to.

Automotive trends to shape the industry in 2020 and beyond

Adapting to today’s automotive industry challenges implies several technology trends that affect how the car industry goes about its day to day business in the next decade, modifying the way consumers use and experience autos. We think these are five key trends to keep an eye on in 2020:

1. Electric cars

The internal combustion engine has been the building block of the auto industry for over a century, but environmental regulation and consumer concerns is driving a shift to hybrid and battery-powered cars. The growing adoption of electric cars is also supported by expanding charging infrastructure and improvements in battery technology.

In 2030, the share of electrified vehicles could range from 10 percent to 50 percent of new-vehicle sales, according to Mckinsey.

2. Fast-moving industry entrants

Brand-new auto brands are a rare occurrence and are usually backed by established manufacturers. Yet the emergence of Tesla as a car brand points to a future roster of novel brands, brands that take advantage of automotive industry disruption such as electrification. At the same time tech firms and consumer electronics players are gaining prominence in the automotive industry via in-car tech.

15% of new cars sold could be fully autonomous by 2030, according to IBM.

3. Shared mobility

Ride-hailing apps like Uber, Lyft and Bolt are incredibly popular but are a relatively recent phenomenon. The popularity of ride-hailing and other types of shared mobility (including car-pooling apps like BlaBlaCar) is set to increase in the 2020s as technology continues to support these trends while consumers seek ways to save money. Indeed, shared mobility is changing the expectations of car ownership – and the purpose of an automobile.

4. Technology integration

The broader influence of automotive technology will continue to drive disruption in 2020 as the established automotive industry increasingly converges with contemporary technology. Cars will cease to be discrete tools that get passengers from A to B. Instead, autos will be integrated into a tech-reliant society, with 16 million 5G-enabled vehicles sold, every year, by the end of the next decade.

5G enabled vehicles sales are expected to reach 16 million in the EU, US and China by 2030, according to PwC.

5. Innovation agility

In 2020 successful auto manufacturers will adjust their R&D processes to innovate faster and in a manner that is more responsive to a changing automotive industry. Doing so will include partnering with vendors previously outside the auto industry and may mean more extensive use of platforming to cater to diverging global consumer needs and requirements. One of the examples can be integrating machine learning technology into manufacturing processes.

Software as a common thread

The wave of technology that is upending the staid automotive industry also implies a shift in the balance between hardware and software. While hardware used to dominate automotive technology there is a clear transfer in that the use of cars is increasingly underpinned by novel software solutions. As a result, suppliers of automotive software solutions are becoming more prominent in the automotive supply chain.

Executives surveyed by IBM rated automotive “hard” skills such as engineering or software development as most critical to their organizations’ success.

At ELEKS we have assisted many automotive industry players to harness the power of software in their field. Get in touch to see how we can help your company to not just adapt to a rapidly changing automotive industry, but to thrive in a changing motoring environment – pivoting off technological change to outpace competitors.

Related Insights

The breadth of knowledge and understanding that ELEKS has within its walls allows us to leverage that expertise to make superior deliverables for our customers. When you work with ELEKS, you are working with the top 1% of the aptitude and engineering excellence of the whole country.

Right from the start, we really liked ELEKS’ commitment and engagement. They came to us with their best people to try to understand our context, our business idea, and developed the first prototype with us. They were very professional and very customer oriented. I think, without ELEKS it probably would not have been possible to have such a successful product in such a short period of time.

ELEKS has been involved in the development of a number of our consumer-facing websites and mobile applications that allow our customers to easily track their shipments, get the information they need as well as stay in touch with us. We’ve appreciated the level of ELEKS’ expertise, responsiveness and attention to details.