Why e-Excise matters?

Dealing with excisable goods like tobacco, alcohol, and e-liquids can be complicated. There is a strong movement toward using digital systems, which would provide better control and transparency.

In Ukraine, this is evident with the new e-Excise system. Producers, importers, distributors, and retailers need to understand this system and adjust their operations accordingly. Failing to meet these requirements can lead to fines between 10% and 100% of the value of unmarked products.

To avoid penalties and ensure seamless business operations under the new regulatory framework, industry experts should start implementing a comprehensive e-Excise transition strategy immediately. This preparation phase should include:

- Assessing the volume of excise products handled by your company

- Determining whether to develop in-house integration capabilities or engage external specialists

- Establishing a timeline for system implementation and staff training

- All alcohol and tobacco businesses in Ukraine must implement the e-Excise system by 2026, with non-compliance resulting in fines ranging from 10% to 100% of the value of unmarked products.

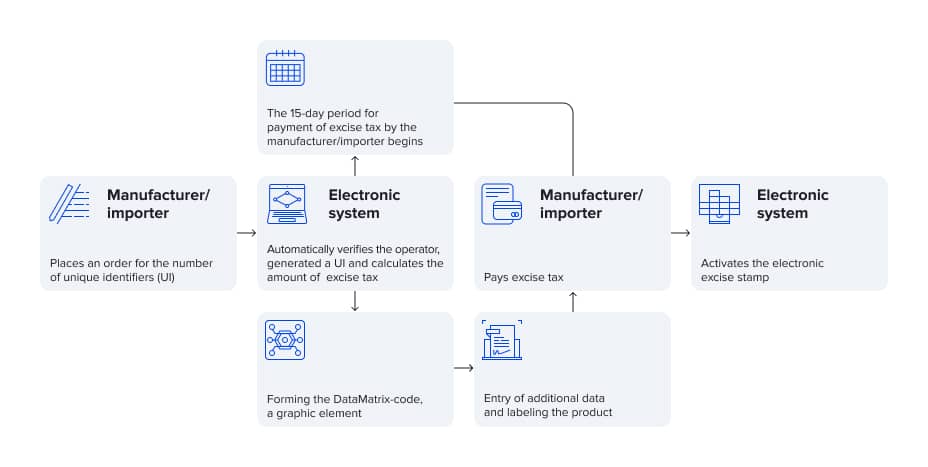

- The e-Excise system uses DataMatrix coding to assign unique product identifiers, enabling real-time end-to-end monitoring from production to retail.

- Businesses can integrate the e-Excise system directly into existing ERP systems via the government's public API, maintaining current workflows without needing new software.

Understanding e-Excise system

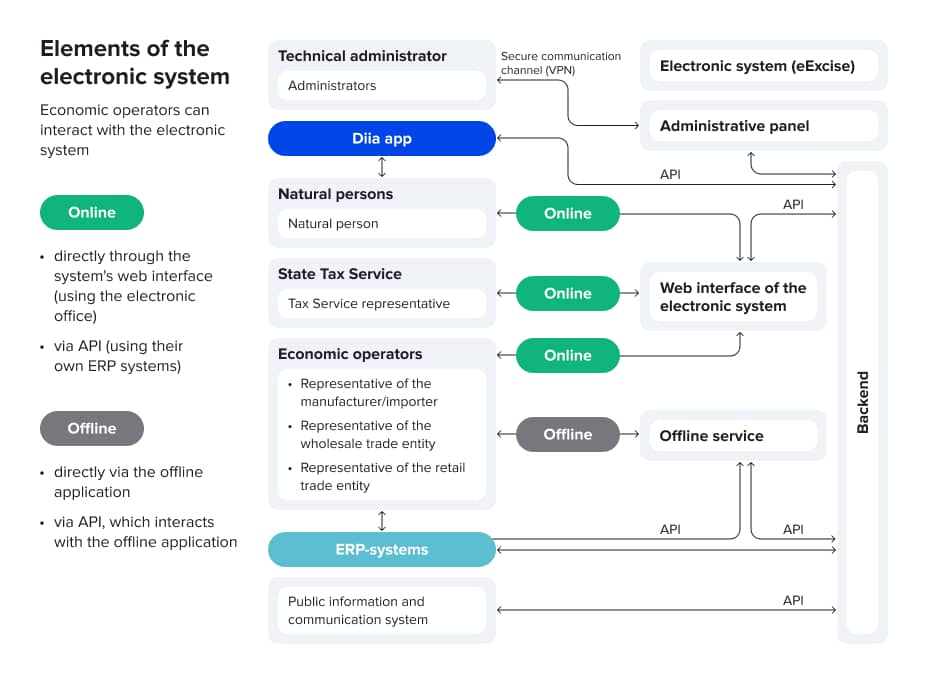

Technical elements of e-Excise system

DataMatrix-based electronic coding system

Each excise product is assigned a unique code containing important information such as manufacturer details, date of manufacture, batch numbers and distribution routes. This digital identification system will become mandatory and will eventually replace traditional paper excise documentation.

Real-time monitoring

The system continuously records and registers data on the movement of goods as they pass through the distribution network. Automatic tracking occurs at every stage from production facilities to retail outlets, allowing regulators to instantly monitor product location and identify any compliance issues.

Business system integration

Organisations are required to connect ERP and accounting systems with state tax service digital platforms. This integration facilitates seamless data exchange, minimises manual data entry, reduces reporting errors and ensures regulatory compliance without creating additional administrative costs.

Key integration challenges that may arise

- System complexity. Navigating the Ukrainian e-Excise system presents significant challenges, as its documentation spans over 400 pages, contains more than 5,000 technical requirements, and involves approximately 50 different integration points, requiring a clear mapping to business workflows.

- Modernisation of technological systems. Companies may need to update their financial and inventory management systems to comply with electronic excise control. This typically requires software modifications, creating new data channels, and integrating different platforms, which can result in significant costs and lengthy implementation times.

- Requirements for investment in equipment. The implementation of electronic excise taxation requires specialised equipment for product identification and tracking. Companies need to budget for thermal printers for excise labels, mobile scanners for QR code verification, and devices for real-time data transfer.

Read more about tax software in our blog post: Understanding Excise Tax Software: Features, Benefits, and Implementation Case Study

What are the e-Excise implementation essentials?

Operator registration and user management

First, businesses must complete system registration and establish comprehensive user training programs. Recognise that you are an economic operator. Get comfortable using the electronic cabinet, which acts as your digital control center. This is where you can manage company data, check licenses, and connect warehouses. The electronic cabinet is also important for integration because it helps you create an API token.

Operational process adaptation

Market operators must ensure that the processes of obtaining and applying excise stamp codes and registering the movement of excise goods in the information system are carried out in accordance with the requirements of the law.

Roadmap of ordering and activating an electronic stamp

Manual labelling involves the risk of errors and delays. In general, businesses will need to adapt to new requirements, which means changes in the warehousing, shipping, and accounting processes.

Conclusions

The mandatory transition to e-Excise represents a significant regulatory shift that requires careful planning and strategic implementation. Companies should begin preparation immediately to ensure compliance by the 2026 deadline while minimising operational disruption and associated costs.

Success depends on thorough system assessment, appropriate technology investment, and potentially strategic partnership with experienced integration specialists. As the government-selected vendor developing this system, ELEKS is your ideal integration partner.

FAQs

To some extent, yes. Particularly due to legal limitations that require some documents to be signed within the system using an electronic signature. Apart from that, you can still use your existing software in 99% of cases.

Yes, you can integrate with several systems from your side to make this process more optimal.

Basically, whatever system you foresee to integrate, meaning the most optimal process on your end.

The maintenance of the system is currently envisioned to be done by the government, in particular SE DIIA.

No specific software is necessary for this process. You can integrate e-Excise directly from your ERP system via the public API shared by the government.

The requirements will vary based on your current business operations and processes. Potentially, you may need new scanners to support 3D scanning of DataMatrix codes.

Related Insights

Inconsistencies may occur.

The breadth of knowledge and understanding that ELEKS has within its walls allows us to leverage that expertise to make superior deliverables for our customers. When you work with ELEKS, you are working with the top 1% of the aptitude and engineering excellence of the whole country.

Right from the start, we really liked ELEKS’ commitment and engagement. They came to us with their best people to try to understand our context, our business idea, and developed the first prototype with us. They were very professional and very customer oriented. I think, without ELEKS it probably would not have been possible to have such a successful product in such a short period of time.

ELEKS has been involved in the development of a number of our consumer-facing websites and mobile applications that allow our customers to easily track their shipments, get the information they need as well as stay in touch with us. We’ve appreciated the level of ELEKS’ expertise, responsiveness and attention to details.