Financial Software Development

What you get with ELEKS’ financial software development

ELEKS is a reliable software development partner trusted by global financial enterprises and world-renowned banks. Our financial software development services empower financial institutions to deliver industry-leading services with enhanced operational efficiency, reduced transaction costs, and streamlined risk management.

With decades of experience in the finance sector and strong expertise in data science, AI, and cybersecurity, we deliver custom data-driven fintech solutions that enable efficient decision-making and the management of complex financial risks. Additionally, our MVP development service and in-house R&D lab allow financial institutions to validate ideas and test new technologies before making significant investments.

We’ll work with you to understand your intricate business needs, help you test your most ambitious ideas and discover if your vision translates into real value for your business. We’ll conduct extensive research and document the outcomes in a way that can be easily replicated further down the line.

Our 30+ years in the technology sector allow us to understand your most complex business needs, then help you map them out, so you can set and achieve clear goals for the delivery of your product features.

Our nearshore team of software experts will partner with you to define your project-level architecture, including design, infrastructure and data architecture. Together, we’ll establish a robust product development life cycle, deliver it smoothly and get it to market faster.

Customer feedback

How we can help transform your

finance function

We provide financial software solutions that help you deliver exceptional financial services, with improved operational efficiency, lower transaction fees and diverse, secure payment options. Our software solutions and R&D support help you manage your data and track performance and attribution.

Fraud and identity theft are among the biggest challenges faced by modern financial institutions. We help tightly regulated finance, banking and insurance businesses create secure storage and transfer, without any third-party involvement.

Our Big Data expertise will help you collate and analyse your data in a user-friendly environment. We’ll enable you to understand insights, so you can build your business around the evidence contained within your data.

Our custom fintech solutions help you develop risk prediction modelling tools to calculate operational risks, in real time. So you can manage major credit, market and operational risks, both time and cost-effectively.

The scope of the services and financial software solutions we deliver

-

Fraud detection solutions

Our cross-functional teams develop custom fraud detection tools that seamlessly integrate with your existing systems, implementing data-driven anomaly detection through multimodal deep learning that continuously adapts to emerging threats. This comprehensive approach helps safeguard financial assets, maintain regulatory compliance, and build lasting customer trust in competitive markets with minimal operational disruption.

Explore custom fraud defence solutions -

Risk modelling

Our experts will help you enable smarter risk assessment and management, at a lower cost. So you can quickly identify and respond to risks while addressing regulatory requirements and compliance obligations.

-

Advanced analytics

We'll help you extract valuable insights from your data, so you can make evidence-based business decisions. Advanced analytics can help you forecast market outcomes and predict drivers of revenue and loss, so you can manage risk and invest in areas that will truly add value – for you and your customers.

-

Real-time data processing

With data on demand, you can respond to customer needs instantly and proactively, while also being able to rapidly detect fraud and stop it in its tracks

Our comprehensive

financial domain expertise

Investment management and brokerage

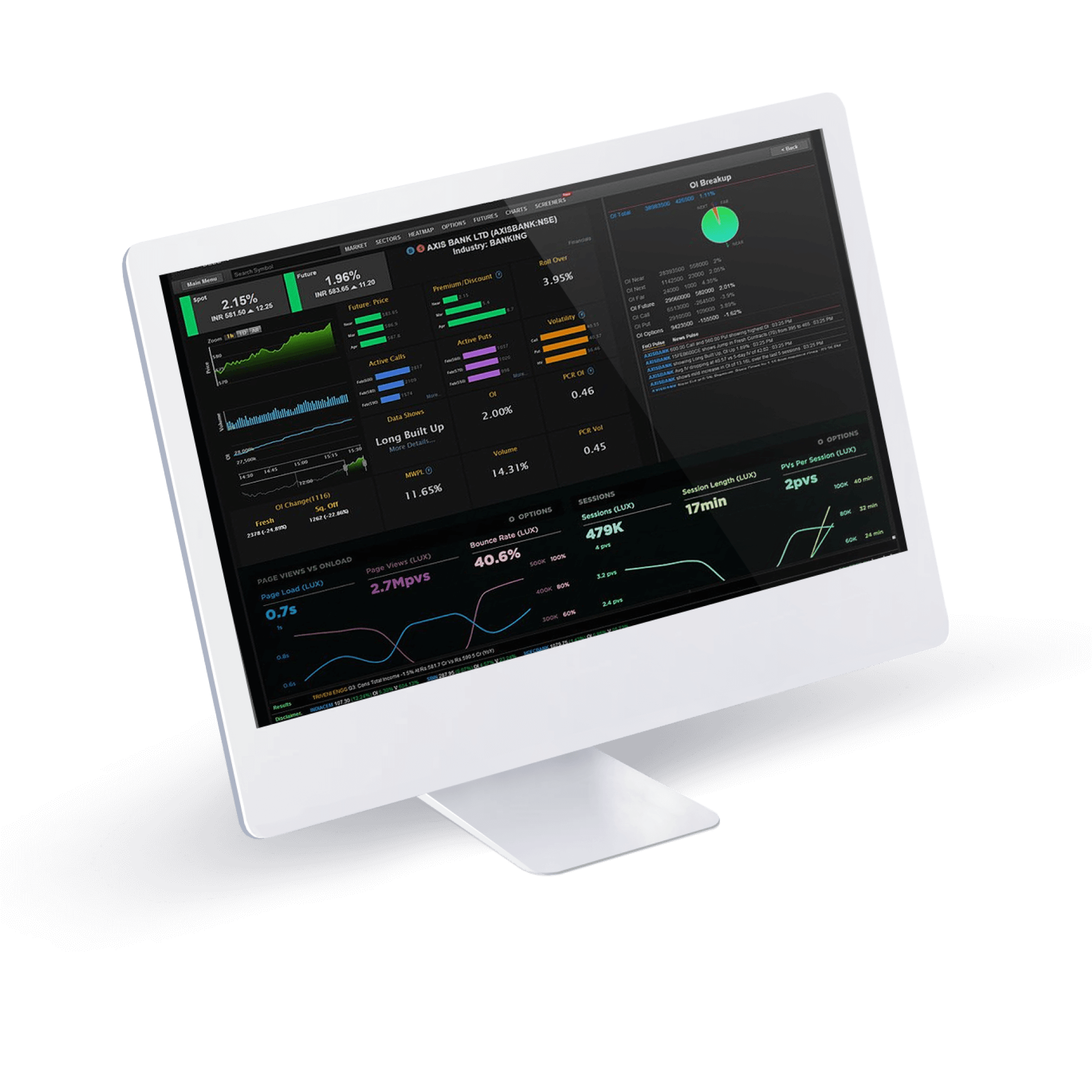

Our software development services fully support the needs of investment managers, covering financial transactions and reporting and providing complete visibility over the performance of their investments. We build custom financial solutions that enable access to real-time global data and provide comprehensive portfolio management tools in one convenient and secure place.

Hedge funds and asset management

ELEKS’ financial software development experts will help you build and implement integrated solutions that cover the entire investment lifecycle of all types of funds – traditional and alternative. So, fund administrators and asset managers can drive operational efficiency and enhance performance whilst reducing risks, ensuring due diligence and keeping sensitive financial data safe.

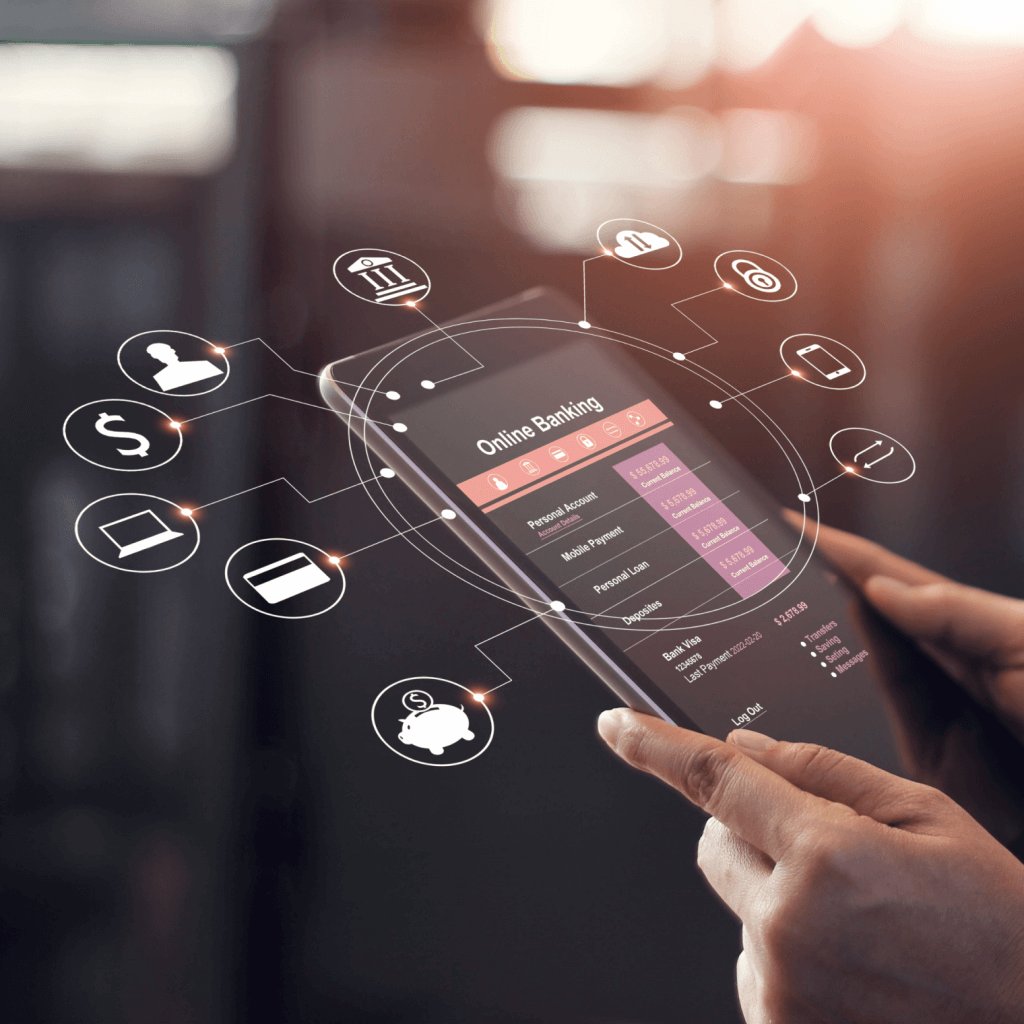

Banking solutions

As a trusted financial and banking software development company, we partner with retail and corporate banks to transform their operations and enable industry-leading customer services without compromising data security or resilience. Our solutions for banks are powered by advanced data analytics and include desktop, web and mobile banking apps, open banking solutions, cloud-based customer portals for internet banking and payments, CRM systems, loyalty management software, and more.

Security management and trading

With ELEKS’ financial software development services, brokers and traders can streamline and automate their trading strategies, collect and analyse market data and monitor accounts and portfolios more efficiently. We build custom software and mobile apps that provide comprehensive capabilities for trading and post-trade deal management, data analytics, reporting and real-time risk management.

Cards and payments

We can help you develop an integrated cloud-based or on-premise platform that supports all global payment methods and covers multiple channels, including e-commerce, ATM, POS, mobile, self-service kiosks, and contactless payments using IoT devices. Our financial software development services help you create a flawless and totally secure payment experience for your customers, so you can scale your business and grow your profits.

Accounting

We build custom fintech solutions that facilitate and support essential accounting operations, transaction management, agent management, commission automation and reporting. What's more, integrated advanced data analytics yield valuable insights that help you make more informed decisions, uncover opportunities and mitigate risks to grow a resilient and profitable business.

Our financial software

development successes

Financial software development FAQs

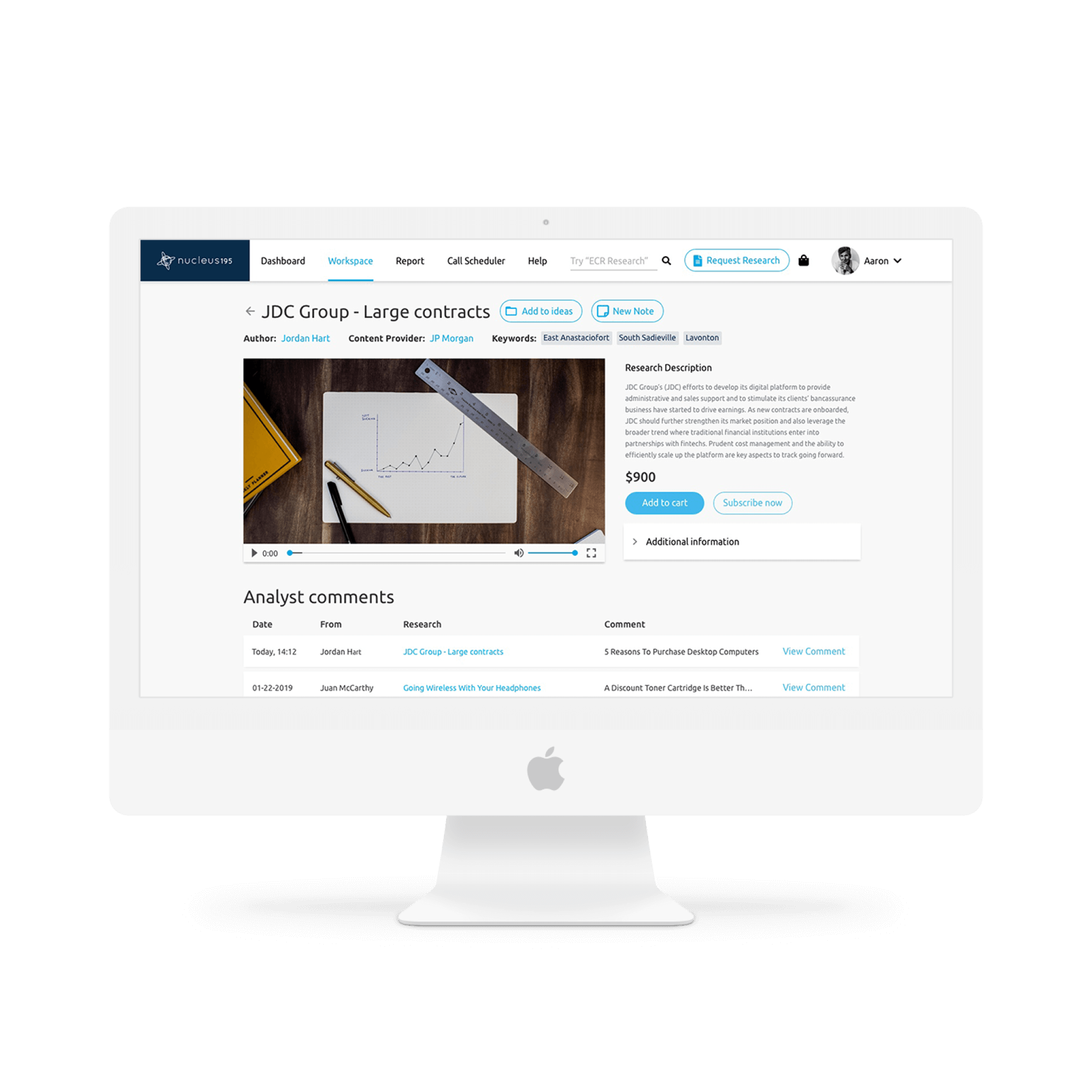

Financial software development services assist banks, investment firms, and other financial institutions in implementing digital solutions to manage their operations more effectively. These solutions encompass transaction processing and risk management tools, customer banking portals, and fraud detection systems. Contemporary financial software integrates data analytics, artificial intelligence, agentic AI, cloud computing, and cybersecurity to address complex challenges in the finance sector.

Cybercriminals target financial institutions because they handle billions of daily transactions and sensitive customer data. Strong security measures protect against data breaches, financial fraud, and regulatory penalties that can damage customer trust and business reputation. Additionally, financial software must comply with strict industry regulations, and security breaches can result in significant fines and legal consequences that threaten business continuity.

Financial software helps enhance business operations by automating manual processes, improving decision-making through data analytics, and enhancing customer experiences. These solutions can also optimise transaction fees, facilitate loan processing, simplify compliance reporting and reduce human error. Data science-based financial software allows the extraction of valuable insights from data for evidence-based business decisions and incorporates advanced analytics for forecasting market outcomes.

The breadth of knowledge and understanding that ELEKS has within its walls allows us to leverage that expertise to make superior deliverables for our customers. When you work with ELEKS, you are working with the top 1% of the aptitude and engineering excellence of the whole country.

Right from the start, we really liked ELEKS’ commitment and engagement. They came to us with their best people to try to understand our context, our business idea, and developed the first prototype with us. They were very professional and very customer oriented. I think, without ELEKS it probably would not have been possible to have such a successful product in such a short period of time.

ELEKS has been involved in the development of a number of our consumer-facing websites and mobile applications that allow our customers to easily track their shipments, get the information they need as well as stay in touch with us. We’ve appreciated the level of ELEKS’ expertise, responsiveness and attention to details.