Custom Banking Software Development

What you get with ELEKS’ banking software development

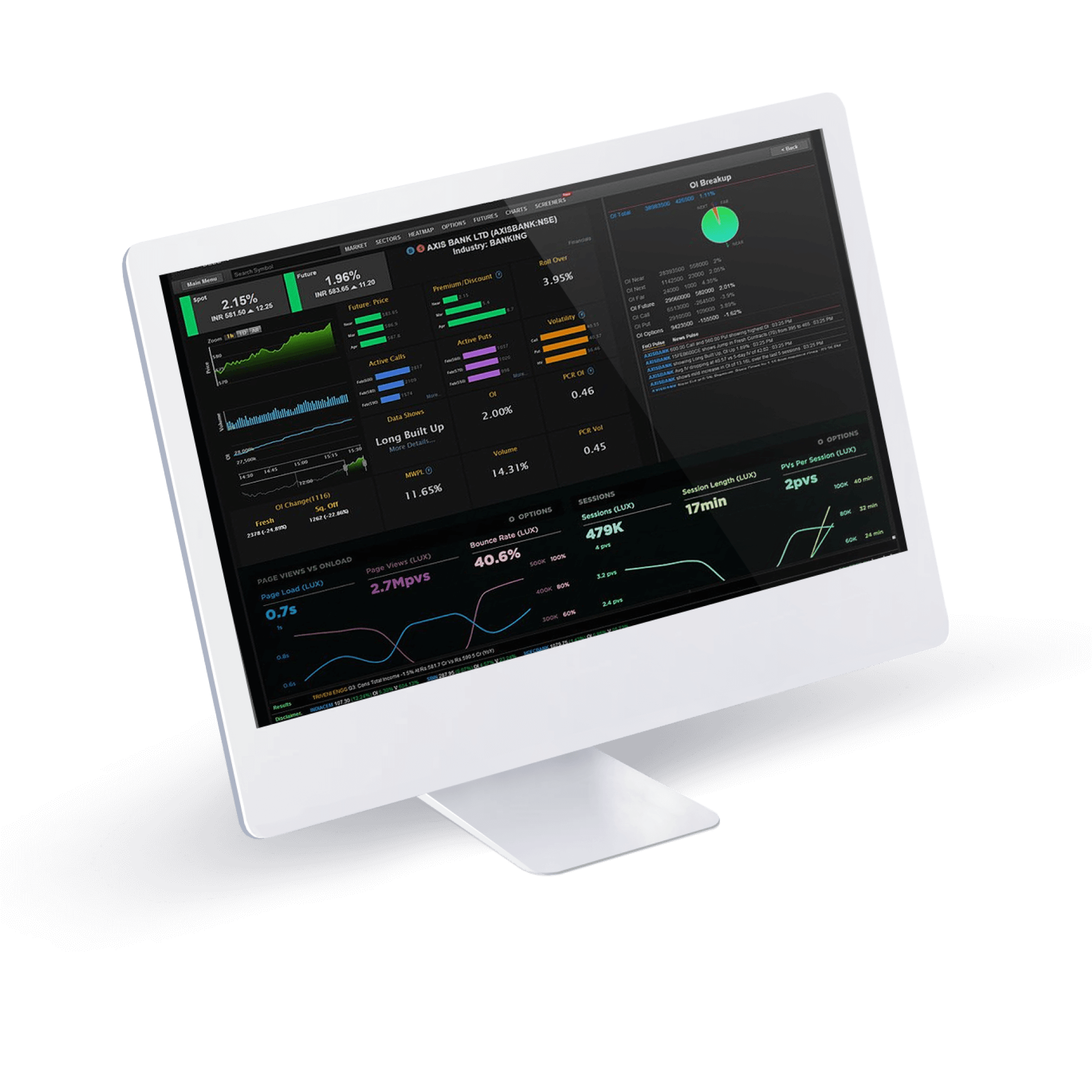

Our expert software development services empower banks to transform operations by prioritising superior customer experiences and streamlined transactions. With decades of experience in the finance sector and strong data science and AI expertise, we deliver custom data-driven solutions that enable financial firms to offer new levels of personalised services, enhancing customer loyalty and engagement.

Trusted by global financial enterprises and world-renowned banks, ELEKS provides tailored solutions, including banking portals and mobile apps, that offer seamless 24/7 access for customers to manage their finances, fostering convenience and satisfaction. Moreover, our banking software prioritises data security and compliance, ensuring robust protection of sensitive information with real-time transaction monitoring and fraud prevention measures.

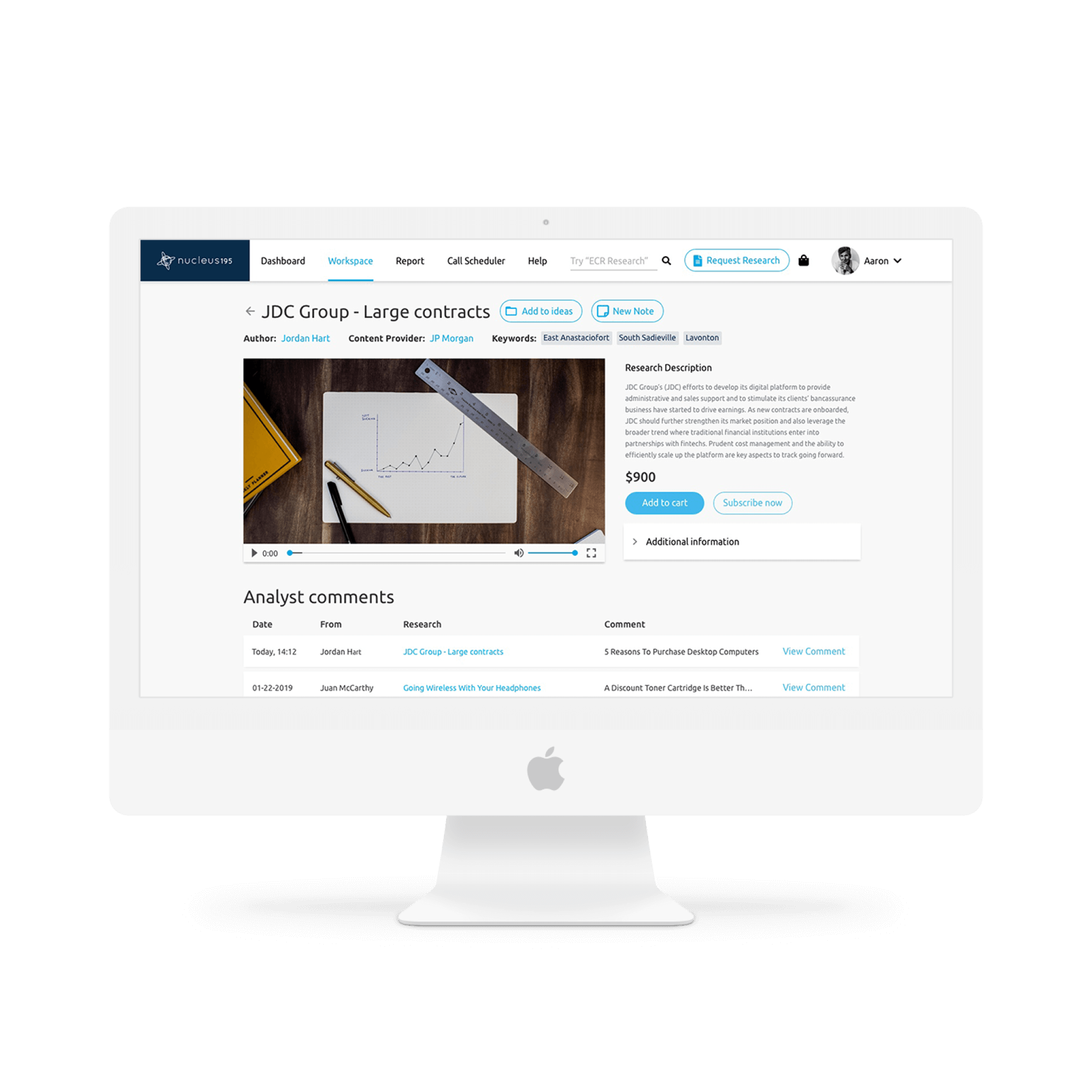

Minimise paperwork with streamlined electronic document management and boost customer satisfaction with accessible and convenient online banking services. We help banks design and develop modern and secure custom digital platforms for online banking, allowing their customers to access and manage their financial accounts and run transactions with ease. Users can perform various financial tasks like checking their balances, transferring funds between accounts or paying bills at any time from any location without visiting a physical bank branch. We’re a banking software development company that prioritises data security, providing encryption and authentication to ensure the safety of users' data and transactions.

Facilitate your essential business processes, services and functions with a custom-built core banking system, including integrated banking document management software that allows you to digitise and automate your bank's fundamental operations. From customer account management, transaction processing, deposit and withdrawal handling to loan management, we will help you design and implement a centralised digital framework for your critical banking processes. We provide banking software development services that help customers design and deliver scalable core banking solutions. Furthermore, our custom banking software can seamlessly integrate with your other software solutions to ensure the efficient and secure handling of all your banking activities.

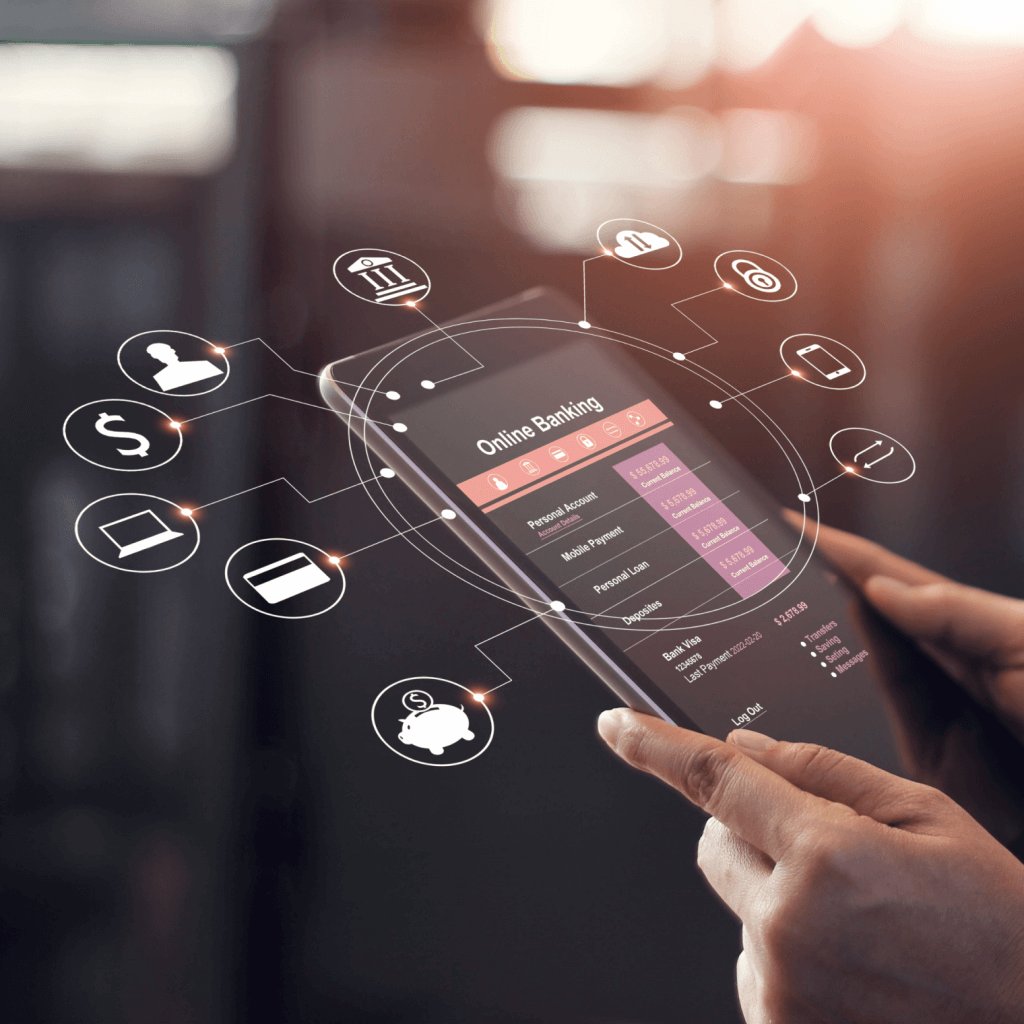

Mobile banking software is a must for modern banks. We’ll help you significantly improve your customer experience by enhancing the convenience and accessibility of your banking services, enabling your customers to access their bank accounts and make financial transactions using their mobile devices. With custom mobile banking solutions developed by ELEKS, your customers can check balances, make payments, transfer funds, locate ATMs and receive real-time notifications about their account activities 24/7 using their smartphones or tablets.

Our team members are experts in banking software development services. They can assist you with payment solutions development, including building and integrating EMV software solutions (Europay, Mastercard, and Visa) with your existing payment gateway systems. So you can maintain regulatory compliance, enable impeccable data security and protection for chip-based card transactions – particularly for credit and debit cards – whilst ensuring your clients benefit from a first-class user experience with full confidence in the safety of each payment.

We provide banks with end-to-end ATM software development services that allow them to effectively manage how their automated teller machines (ATMs) operate. The custom ATM software systems we build and integrate allow banks to ensure the secure authentication of users, reliable cash dispensing and accurate transaction recording while their customers can effortlessly, quickly and safely perform cash withdrawals, balance inquiries and fund transfers without the need for visiting a branch. We also help banks enable ATM security through sensitive data encryption, card skimming and fraud prevention features.

Customer feedback

What you can achieve with custom banking

software development from ELEKS

We build software solutions that help financial firms create enhanced, user-friendly interfaces and loyalty-boosting personalised customer experiences. Customers can effortlessly manage their finances with tools such as online banking platforms, mobile apps and self-service features that enable them to make transactions, transfer funds and keep an eye on their accounts anytime and from anywhere in the world.

ELEKS’ banking software development services help finance companies enable intelligent automation for their manual processes, giving them more time to focus on building their business while minimising human error. With automation, operations such as account management, compliance reporting, loan approval, and transaction processing are streamlined, allowing the bank to gain efficiency while saving money.

Tailored bank software development can strengthen a finance firm’s security processes with features like encryption and authentication. So banking institutions can keep sensitive information and financial data safe and build customer confidence while meeting all the necessary industry regulations and compliance requirements (KYC (Know Your Customer), anti-money laundering (AML), etc.).

Banks hold a huge amount of customer data, and with the right banking software, this can be collated and analysed at scale to yield valuable, actionable insights. With this data, banking businesses can gain a better understanding of customer behaviours, needs and individual preferences, so that they can offer personalised services and recommendations with more opportunities to cross-sell features and services.

ELEKS develops custom banking software to establish real-time transaction monitoring. So, banks can proactively identify suspicious patterns and activities, thereby preventing instances of fraud before they can cause serious reputational or financial damage. This, in turn, builds trust and keeps customers loyal to your institution.

Banking software development enables finance companies to harness the power of technical innovation, creating financial products and services that stay ahead of the curve. Borrowers and lenders can connect effortlessly via peer-to-peer lending platforms, which feature AI agents and intelligent assistants powered by generative AI. These tools are increasingly appealing to tech-savvy, time-constrained customers while allowing banks to tap into new revenue streams.

What's included in our banking software development services

-

Research and consulting

As a research and technology expert and banking software development company, we combine strong domain expertise with decades of software engineering experience. Our team will collaborate closely with you to learn about the challenges you face in your banking operations. We'll then use this understanding to map out a modern banking software solution that precisely meets your requirements and addresses the needs of both your financial institution and customers. We'll do thorough research and document our findings so that we can apply this knowledge while developing and deploying your banking software.

-

Business analysis and requirements management

We'll deep-dive into your banking operations and processes to understand and mark out even the most complicated and specific requirements. Then, we'll help you organise them and set clear and achievable goals. We'll create a robust plan for building your banking software solution, incorporating all your needs and translating them into advanced features. And we'll make sure the solution meets every requirement and objective set.

-

Custom application development

Our team of banking software development experts will work on defining the architecture of your solution, encompassing design, infrastructure and data elements. After that, we’ll initiate the application development process to deliver a tailored banking software solution that aligns with your scope, timeline and budget. We engage the best experts in data science, DevOps, quality assurance, and cybersecurity to ensure your banking software incorporates the latest technology capabilities and most advanced data-driven features, while adhering to requirements regarding quality, security, and compliance.

Our banking sector success stories

Custom banking software development FAQs

Banking software development creates digital solutions that help banks manage their operations, serve customers, and handle financial transactions securely. This field involves building applications for online banking, mobile banking, loan processing, payment systems, and regulatory compliance. Modern banking software can combine data analytics, business intelligence, cybersecurity, artificial intelligence, agentic AI and more.

Modern banking software improves customer experience by providing convenient, personalised, and accessible financial services across multiple channels. Custom mobile banking solutions enable customers to check balances, make payments, transfer funds, locate ATMs, and receive real-time notifications about their accounts. The software can also provide integration across devices, instant transaction processing, and proactive customer support through AI-powered chatbots and personalised financial insights.

Banking software systems typically include features that support customer-facing services and back-office operations. Common features include secure online and mobile banking portals, real-time transaction processing, account management tools, and automated loan origination and servicing capabilities. Additional features can encompass payment gateway integration, customer relationship management (CRM) systems, regulatory compliance tools, risk management dashboards and more.

The breadth of knowledge and understanding that ELEKS has within its walls allows us to leverage that expertise to make superior deliverables for our customers. When you work with ELEKS, you are working with the top 1% of the aptitude and engineering excellence of the whole country.

Right from the start, we really liked ELEKS’ commitment and engagement. They came to us with their best people to try to understand our context, our business idea, and developed the first prototype with us. They were very professional and very customer oriented. I think, without ELEKS it probably would not have been possible to have such a successful product in such a short period of time.

ELEKS has been involved in the development of a number of our consumer-facing websites and mobile applications that allow our customers to easily track their shipments, get the information they need as well as stay in touch with us. We’ve appreciated the level of ELEKS’ expertise, responsiveness and attention to details.